Spodaj je dobra grafična analiza Brada Setserja zadnjih kitajskih zunanjetrgovinskih podatkov. Glavni poudarki analize so:

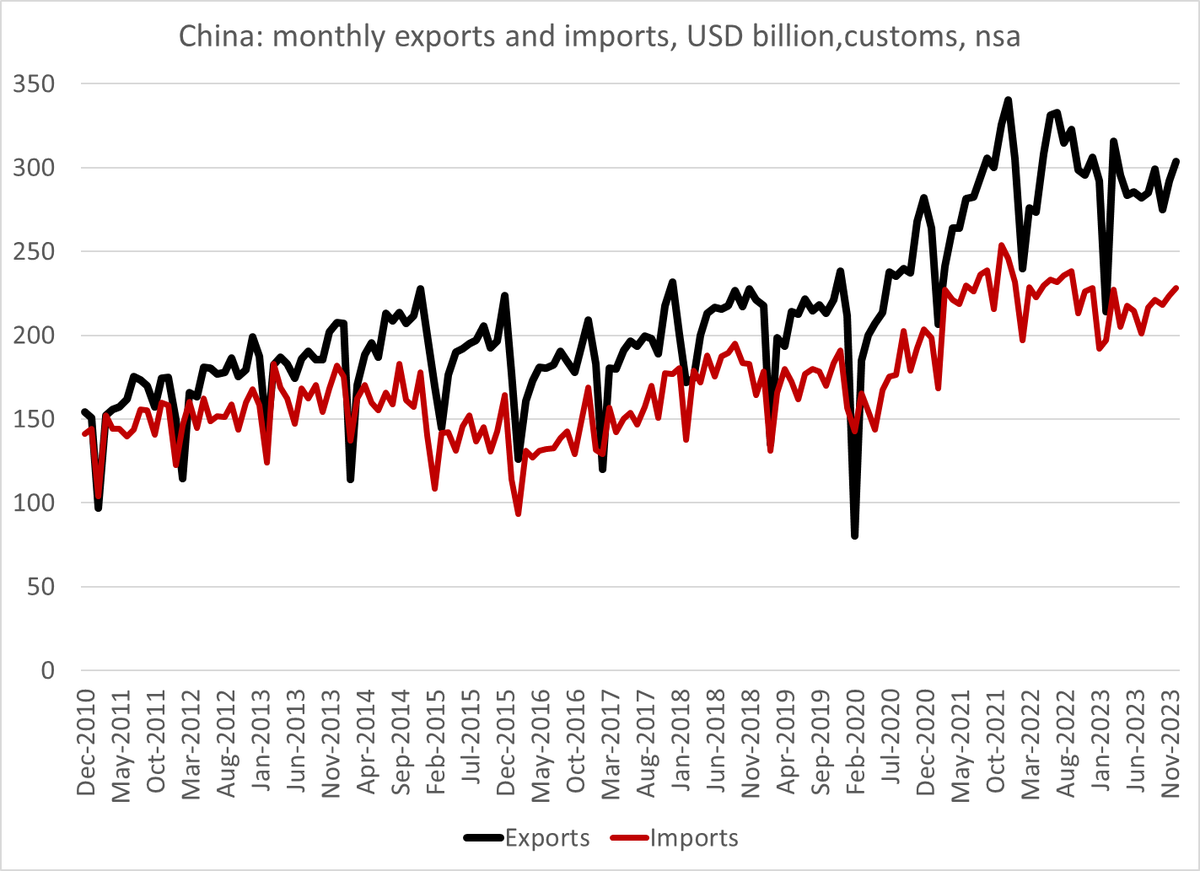

- rast kitajskega izvoza se je lani sicer zaustavila, vendar na ravni okrog 3,500 milijard $, kar je za 1,000 milijard $ več kot pred pandemijo,

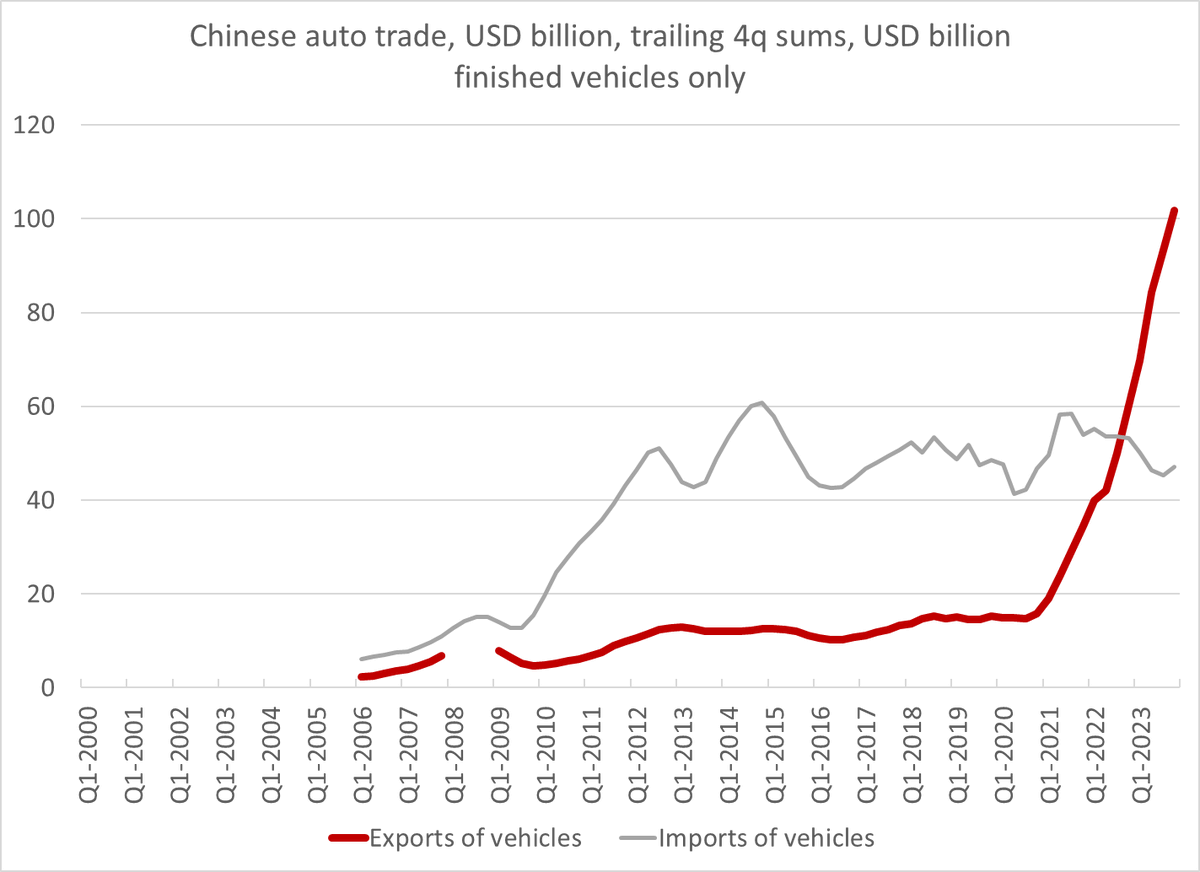

- Kitajska je postala največji svetovni izvoznik avtomobilov in prehitela Japonsko,

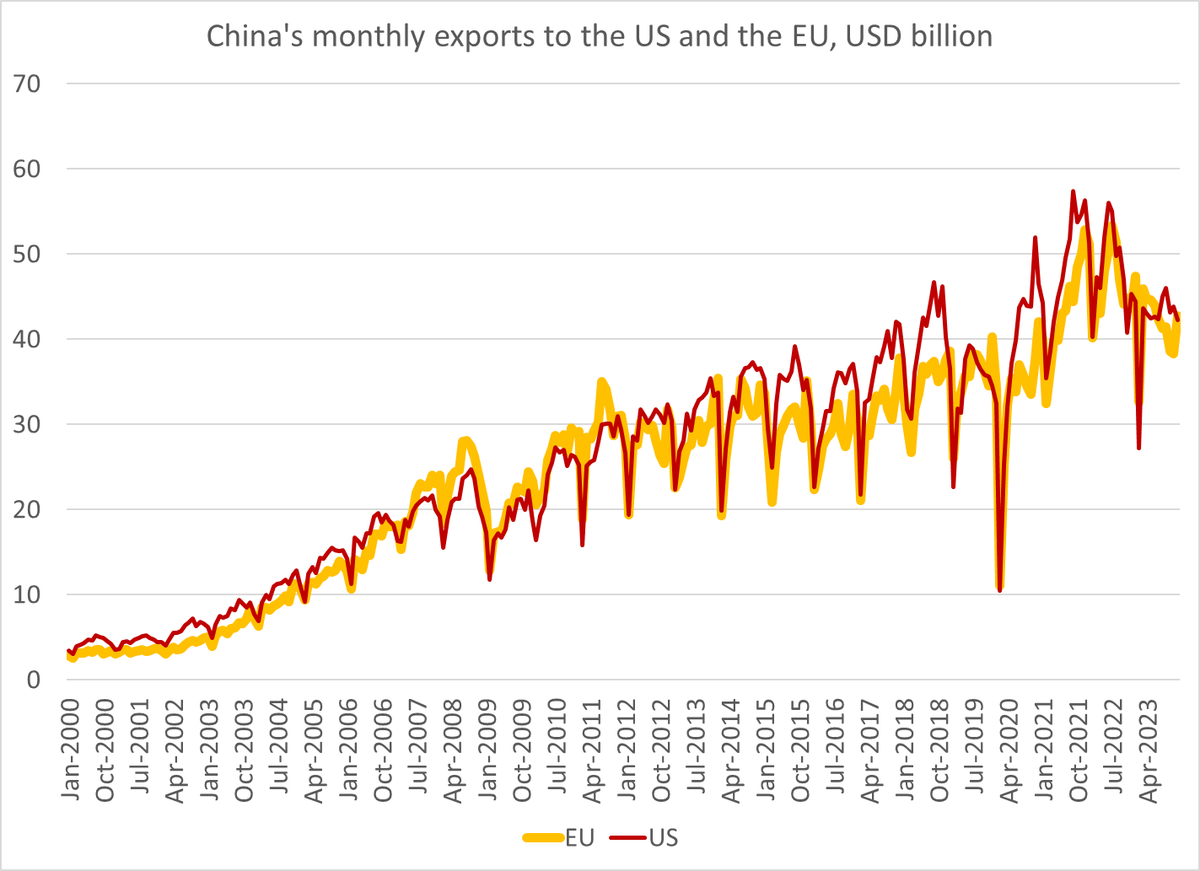

- medtem ko se izvoz kitajskih avtomobilov povečuje, se je zasutavil izvoz potrošnih dobrin (zaradi zmanjšanja zasebne porabe v Evropi in ZDA zaradi inflacije),

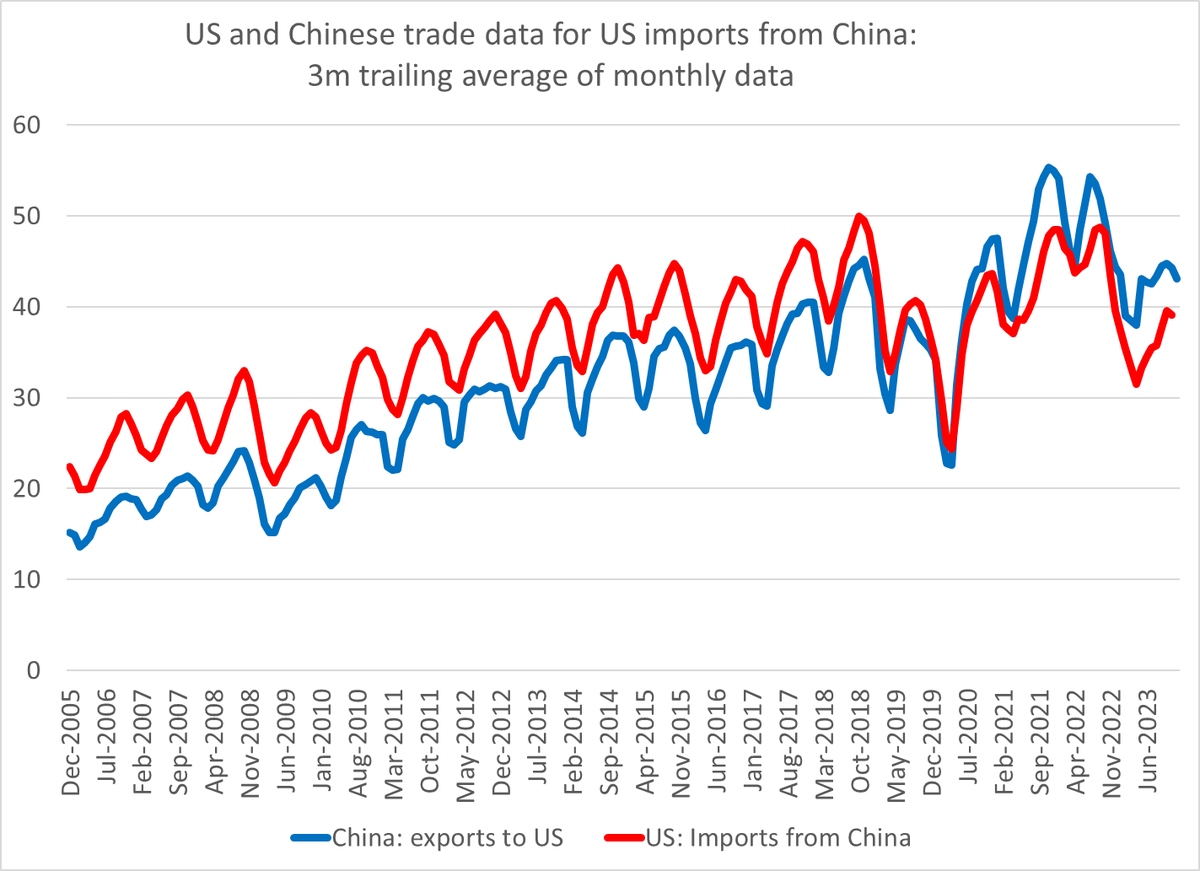

- ameriška trgovinska vojna proti Kitajski ni imela posebnega učinka na zmanjšanje uvoza iz Kitajske (ta je višji kot pred uvedbo Trumpovih trgovinskih vojn),

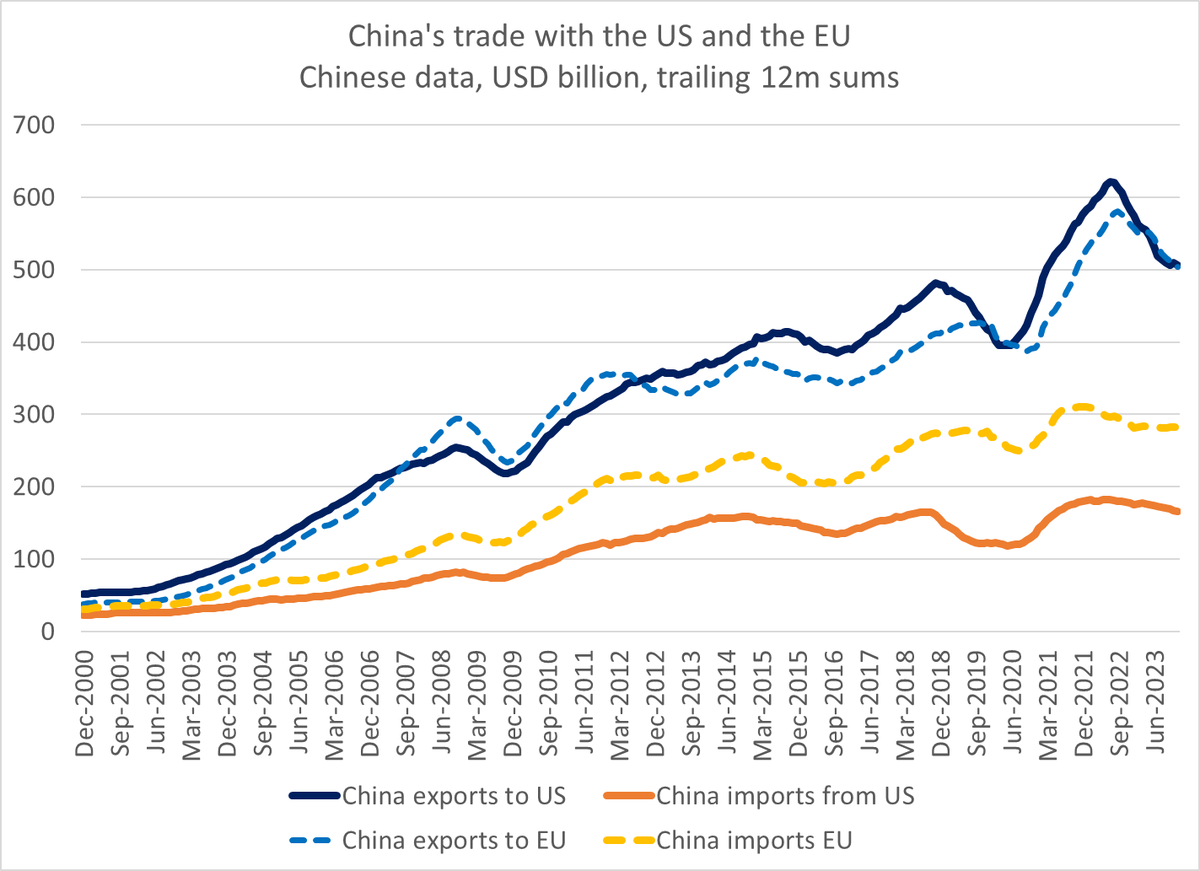

- sedanji zastoj rasti agregatnega izvoza Kitajske je bolj ciklične narave (šibko povpraševanje v zahodnih državah) kot pa strukturne narave (vpliv trgovinskih vojn, tehnoloških sankcij),

- o deglobalizaciji zaenkrat ni govora, se pa dogaja pomembno prestrukturiranje, ki bo imelo negativen vpliv predvsem na gospodarstva zahodnih držav,

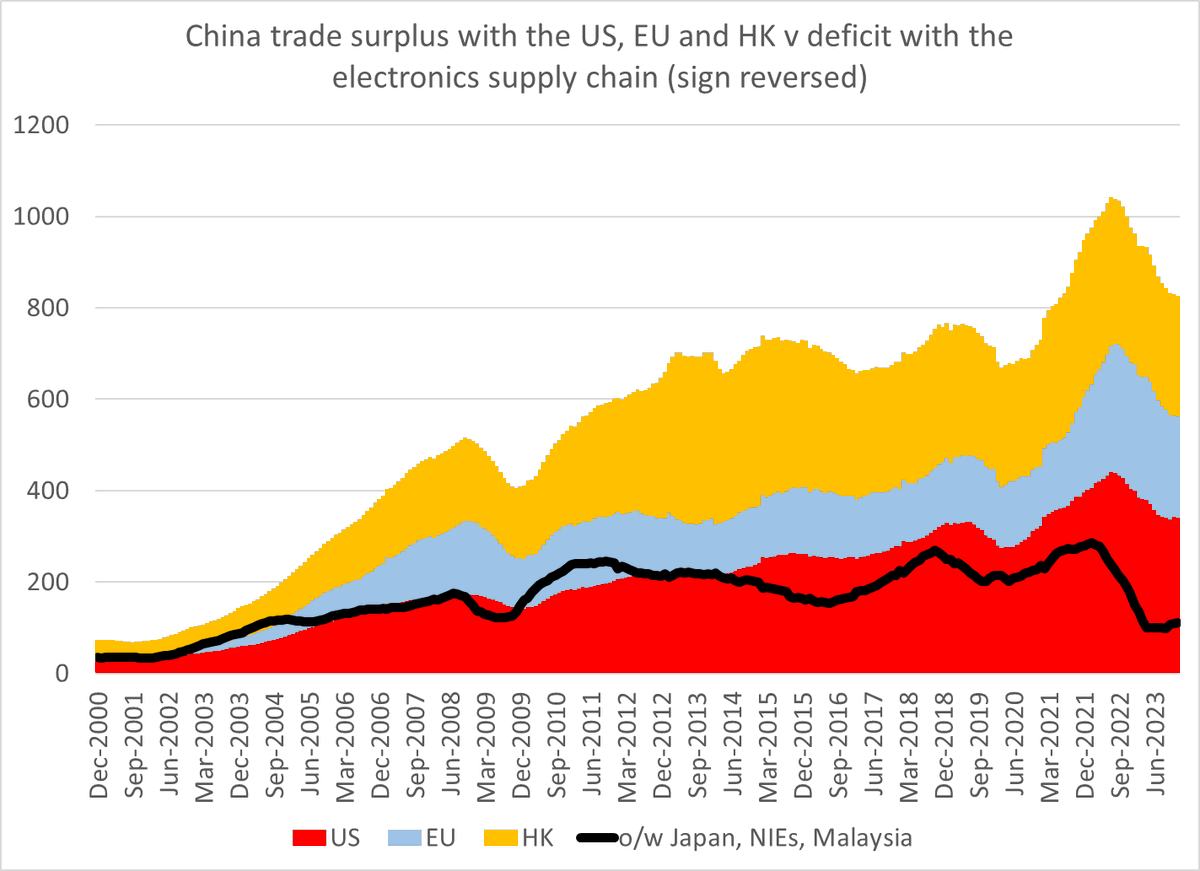

- pomembne strukturne spremembe v kitajskem modelu: zmanjšan uvoz komponent za vgradnjo v izvozne izdelke in povečan domači sourcing teh izdelkov (posledica strahu pred tehnološkimi sankcijami), kar povečuje odpornost kitajskega gospodarstva na morebitno zaosstritev ameriških protekcionističnih ukrepov (kar pa ni dobro za zahodne dobavitelje, ki so do sedaj kitajskim podjetjem dobavljali te komponente).

China’s December trade data is out. And that is an excuse to take stock of the state of the world’s export superpower.

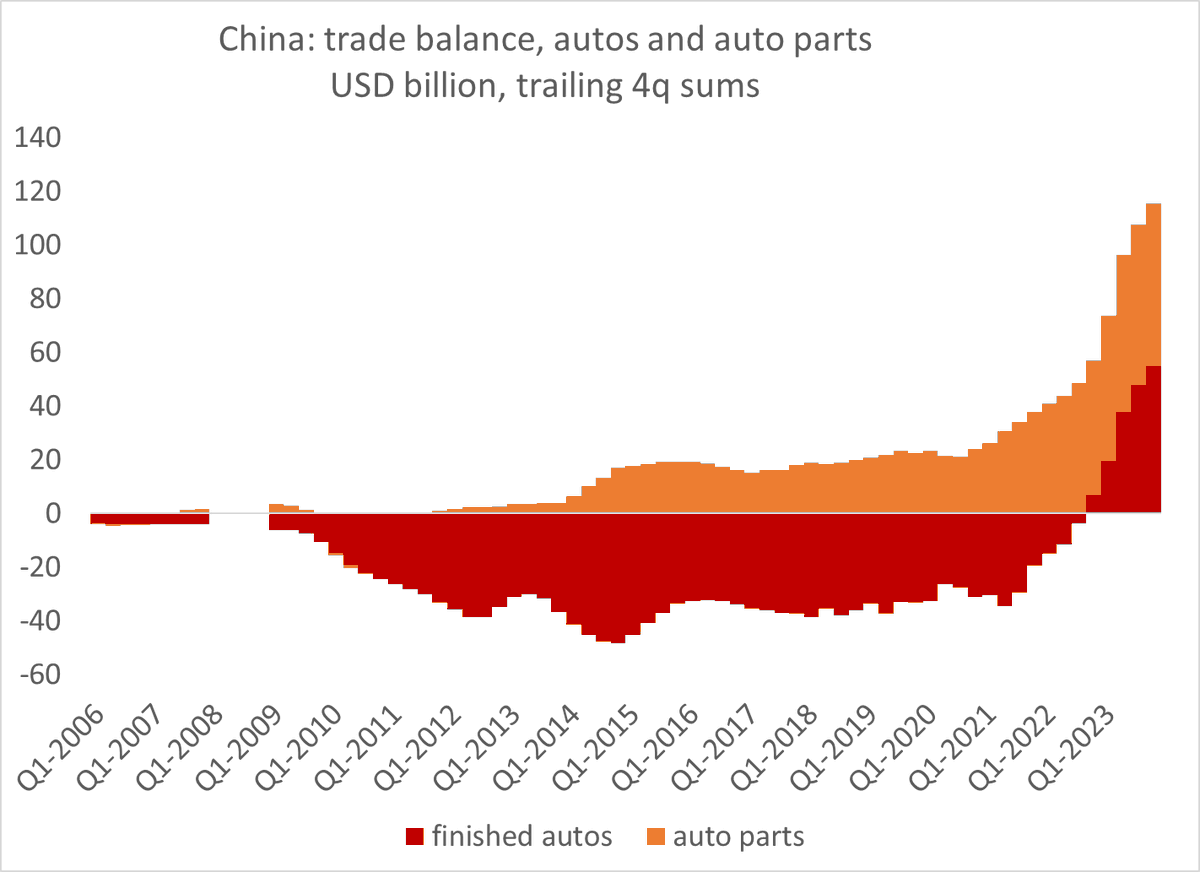

Vehicle exports topped $100b this year for example (up from $15b or so in 2020)

China’s swing into a $40b deficit in autos after the global financial crisis had a profound impact on German politics (reinforcing Merkel’s own views I assume). So I don’t think it should be surprising that the bigger swing now in reverse is also having an impact …

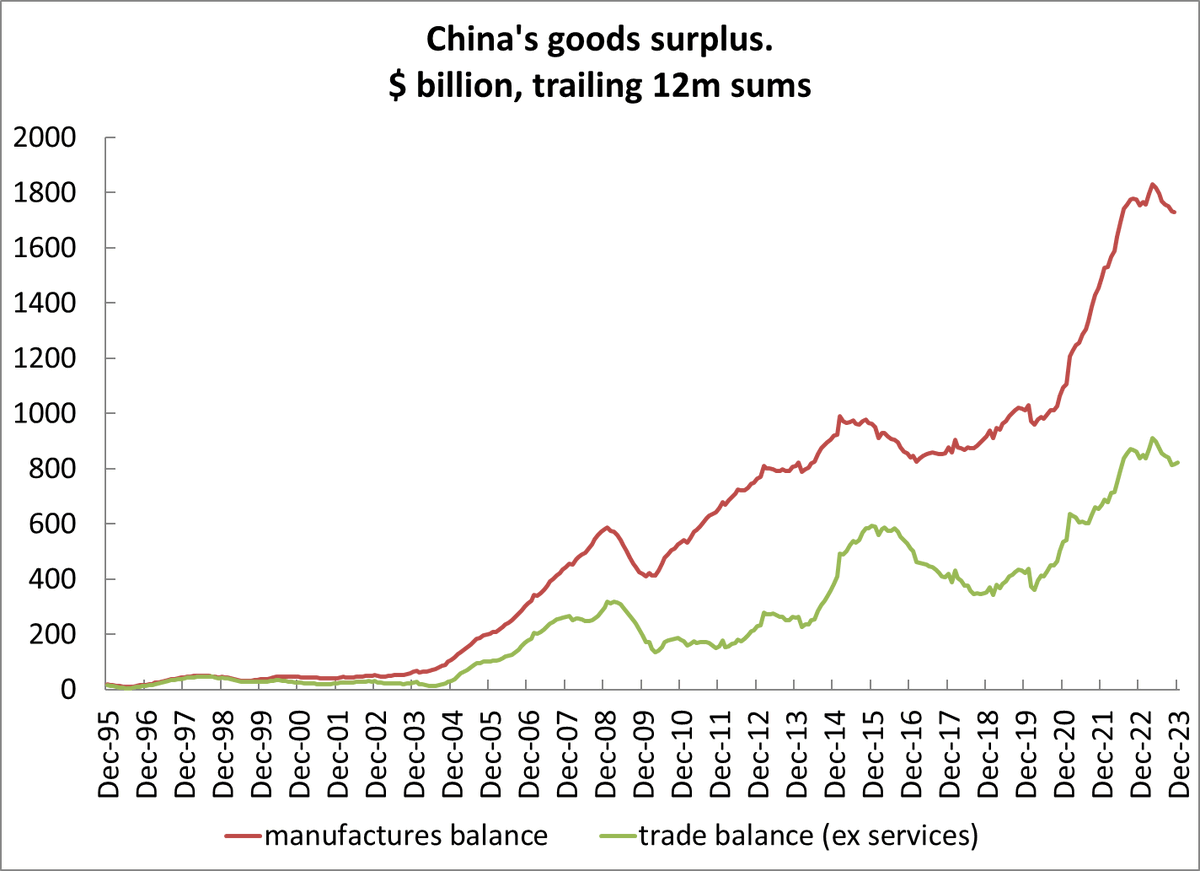

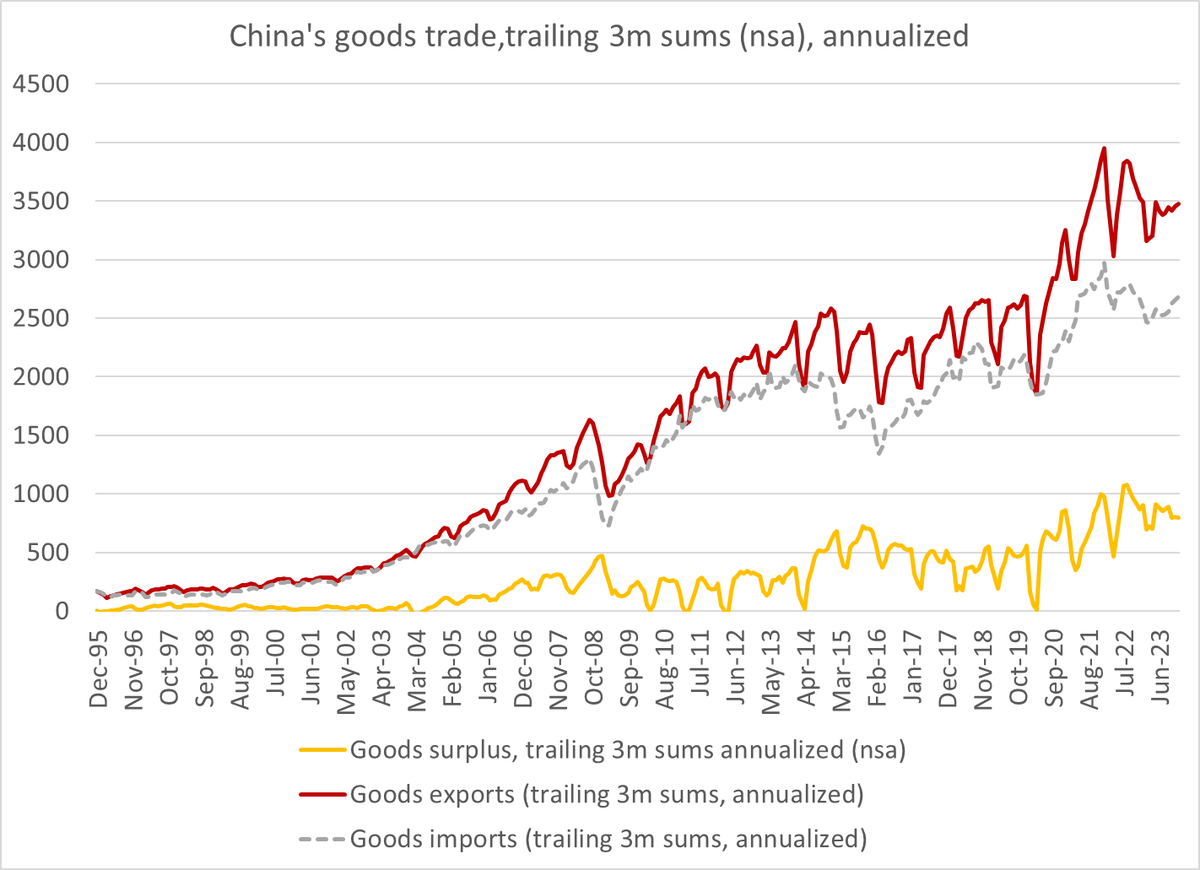

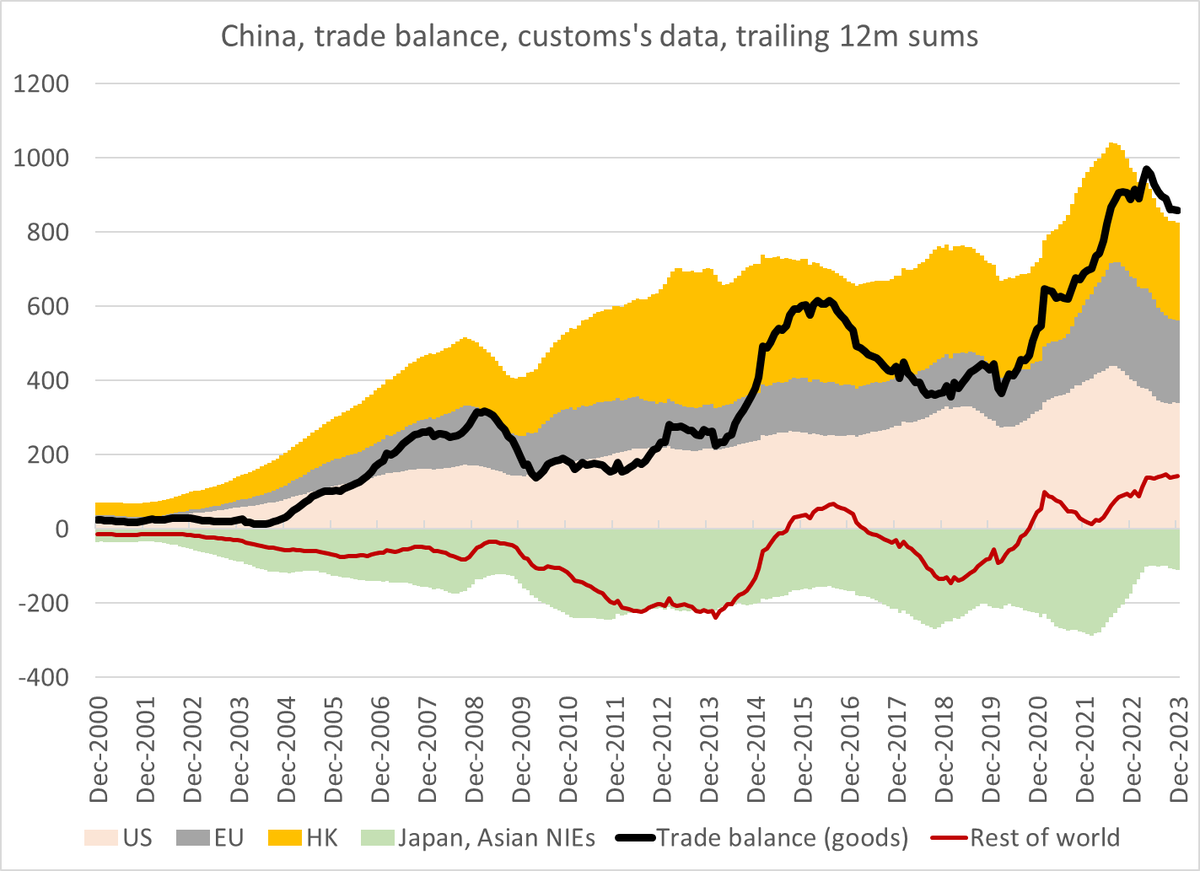

Autos of course are the bright spot in China’s 2023 trade data. Overall export growth clearly stalled — largely due to a global slowdown in spending on consumer goods. China’s surplus has stabilized at around $800b ($1700b for manufactures alone)

Overall exports are running at a roughly $3.5 trillion annual pace — about a trillion dollars more than before the pandemic.

This alone is a hard fact to square with all the talk of deglobalization. China isn’t exporting to Mars.December exports were up a bit in USD terms y/y — but that isn’t all that impressive given the weak q4 2022 base.

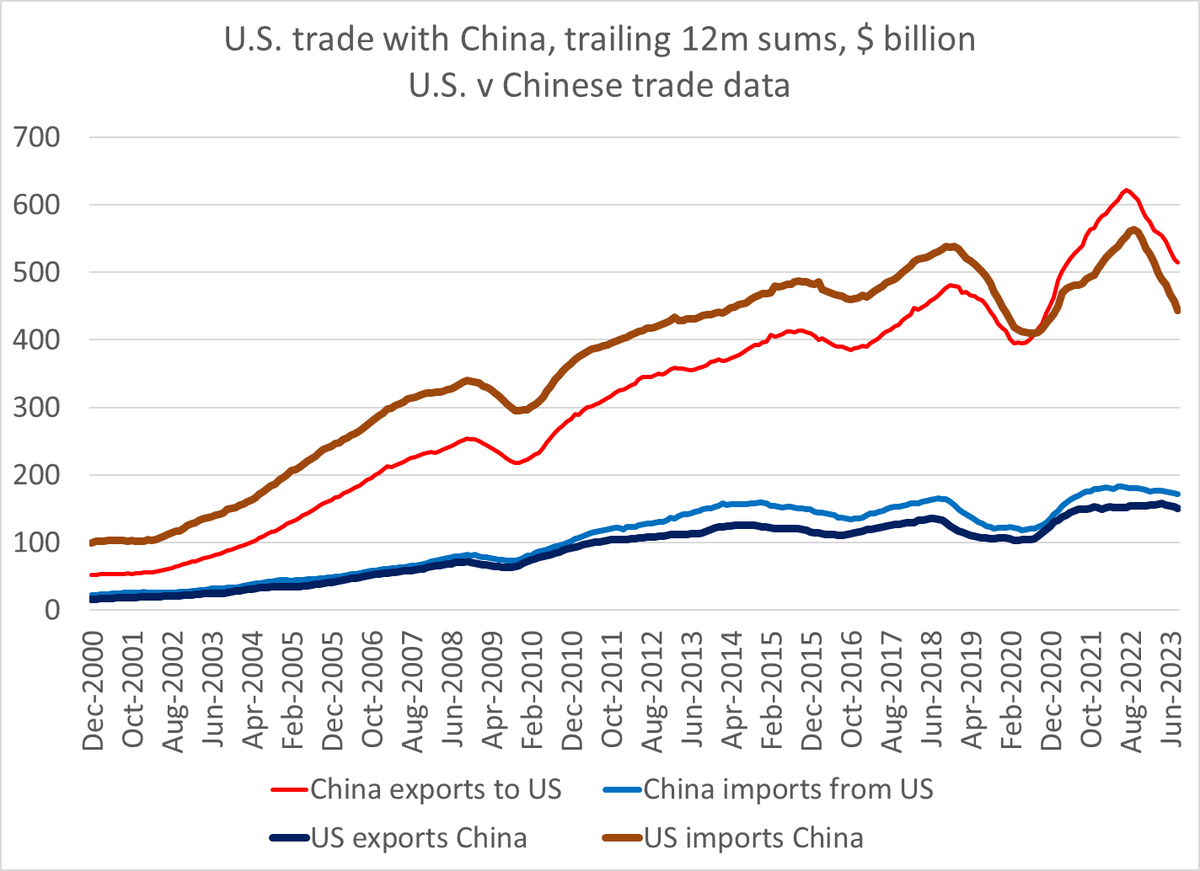

A couple of charts that are I think important for understanding China’s bilateral trade with the US (and there is clearly indirect trade through SE Asia).

The Chinese export data shows a much less pronounced fall over time than the US import data (the “Shein” effect)And in the Chinese data, there isn’t much of a gap between the fall in exports this year to Europe (no tariffs) and the US (tariffs on 2/3rds of trade, big tariffs on 1/2 of trade)

That correlation, plus the consumer goods inventory cycle and pandemic goods trade fall off, leads me to think a portion of the current weakness in Chinese exports to the US is cyclical not structural (a lonely position … )

Remember the phase one deal (its negotiation was the big story of 2019) and the boom in US exports to China that was promised …

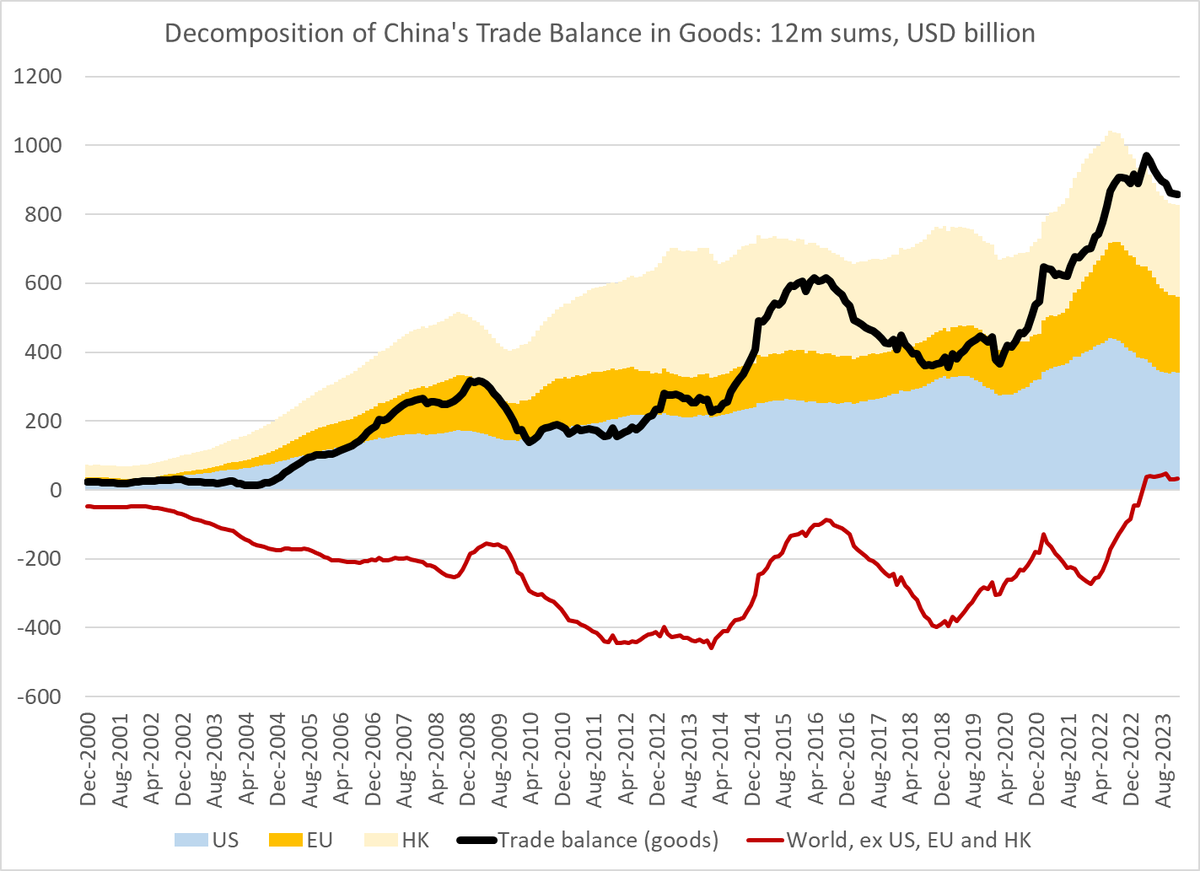

Did not happen.China’s surplus has stayed up amid y/y weakness in exports to the US and EU (to be sure China exports to Europe are still way up v 2019) because China’s trade balance with the rest of the world improved bigly in 2023. Auto exports. Smaller oil bill.

Richard Baldwin recently noted that China stopped just importing parts for reexport back in 2004 — and that is very clear now in the bilateral trade data with east Asia (plotted against the surplus with the US and the EU)

And, apart from the (reduced) deficit with the semiconductor superpowers in East Asia, China runs a surplus with all the big trading blocks these days — including the commodity exporters in aggregate.

China’s trade data contains multitudes, and supports multiple narratives.

But it should be beyond debate that China’s exports & trade surplus are way up since the Trump tariffs and the pandemic.

Narratives around deglobalization need to account for that stylized fact.

Vir: Brad Setser, X