“Star liberal leftist economic historian, Adam Tooze was equally affronted by Wolf’s orthodox position. “The angst now is about inflation persistence. Getting it back down to 2 per cent is the battle-cry. As it was half a century ago, this is a profoundly conservative political argument dressed in the garb of economic necessity. So this is where we have arrived in 2023: to bring inflation back to 2 per cent while preserving the banks, common sense insists that we need higher interest rates for longer, plus austerity. And, at this point, you have to ask whether western elites have learnt anything from the last decade and a half.” The call for austerity was “the old neoliberal logic of “there is no alternative”. Tooze argued that “in pursuit of lower inflation, monetary austerity risks the same fate. It is time to steer the stampeding herd away from the cliff edge, for the sake of the financial security of millions of people and the credibility of our policy institutions.”

Global economic growth is slowing. There is a global manufacturing recession already in place: the latest surveys of economic activity in the major economies show that there is an outright contraction in manufacturing in all the major economies – and it is getting worse.

US ISM manufacturing index (score below 50 means contraction)

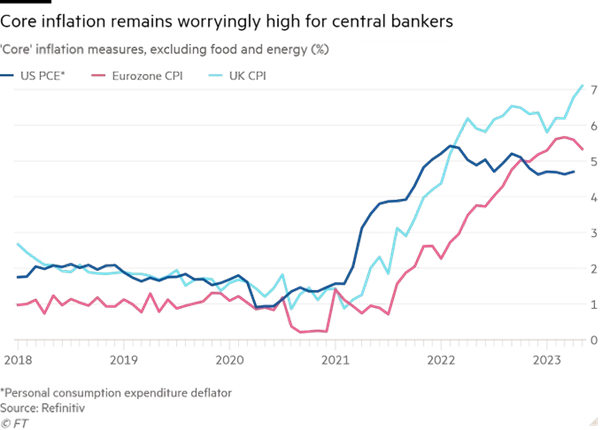

But inflation of prices outside of food and energy, the so-called core inflation rate, is not falling in the major economies.

Central bank chiefs continue to shout the mantra that interest rates must rise to reduce ‘excessive demand’ in order to get demand back in line with supply and so reduce inflation. But the risk is that ‘excessive’ interest rate hikes will accelerate economies into a slump before that happens and also engender a banking and financial crisis as indebted companies go bust and weak banks suffer runs on their deposits.

The stock markets of the world…

View original post 2,515 more words