Včeraj sem se pridušal, da so sedanji ukrepi ameriškega FED podobni “loncu s špageti” (spahgetti bowl). FED je v času mešanega ponudbeno-povpraševalnega šoka poskusil znižati inflacijo z ukrepom, ki se uporablja za ohlajanje gospodarstva v času povpraševalnega šoka (z zviševanjem obrestne mere in črpanjem likvidnosti iz finančnega sistema). Načeloma s tem ukrepom toliko podraži investicije in kredite gospodinjstvom, da se gospodarska aktivnost ohladi, gospodarstvo pade v recesijo, posledično pa inflacija pade. Ko imamo opravka še s ponudbenim šokom (denimo, ko inflacijo poganjajo pomanjkanje surovin in inputov ter visoke cene energentov, povzročene z eksternimi šoki, ki niso posledica povečanega povpraševanja), postane zadeva problematična, saj so potrebni višji dvigi obrestnih mer, da bi gospodarstvo povsem ohladili in da bi posledično padla inflacija. No, ti višji dvigi obrestnih mer pa imajo negativne učinke na bilance bank zaradi inverzne relacije med obrestno mero in ceno obveznic, ki jih držijo poslovne banke bodisi na aktivni strani kot kritje za depozite ali na pasivni strani kot zavarovanje za kredite. In ameriški Fed je s to politiko tako privedel do zloma dveh sicer manjših poslovnih bank (SVB in FR), kar pa je načelo finančno stabilnost celotnega bančnega sistema, zaradi česar je moral FED v sistem napumpati za dodatnih 2 tisoč milijard dolarjev sveže likvidnosti, 5 največjih centralnih bank pa je šlo v koordinirano akcijo zagotavljanja medsebojne likvidnosti.

Ergo, tako smo prišli v situacijo, ko ima FED na voljo en instrument (obrestna mera), z njim pa poskuša zadeti tri cilje: stabilna nizka raven cen, polna zaposlenost in finančna stabilnost. In ko cilja enega, aktivno ruši drugega. Zraven pa na eni strani črpa likvidnost iz sistema s prodajo obveznic, na drugi strani pa v sistem pumpa ogromne količine sveže likvidnosti z odkupom obveznic od finančnih institucij. Kakšen je lahko v teh pogojih učinek na finančno stabilnost? Kakšen je lahko učinek na kreditne pogoje? In kakšna naj bo nova obrestna mera za refinanciranje (Federal Funds Rate, FFR) oziroma za koliko naj FED dvigne FFR ta teden?

Nikomur ni jasno, kakšen okus se bo na koncu zakuhal v tem loncu s špageti. Spodaj je zapis Jasona Furmana, nekdanjega vodje Sveta ekonomskih svetovalcev pri predsedniku Obami, ki poskuša na tej osnovi predvideti, kakšen naj bi bil novi FFR. Kot vidite, je njegov razpon lahko med 0 in 8%. Čeprav sam na podlagi ugibanja na koncu predvideva, da naj bi FED ta teden dvignil FFR morda za četrtinko odstotka. Če pa ga bo pustil na isti ravni, bo pač Furman ustrezno spremenil svoj pogled…

Če je znanost “eno samo ugibanje“, kot priznavajo nekateri znanstveniki, kaj je šele potem ekonomska politika?

___________

Where are we now? 4 propositions:

1. Need less demand

2. Need to avoid nonlinearily massively less demand due to a banking crisis

3. Fed should make only limited use of interest rates for financial stability

4. Fed should take into account tightened financial conditions.

…

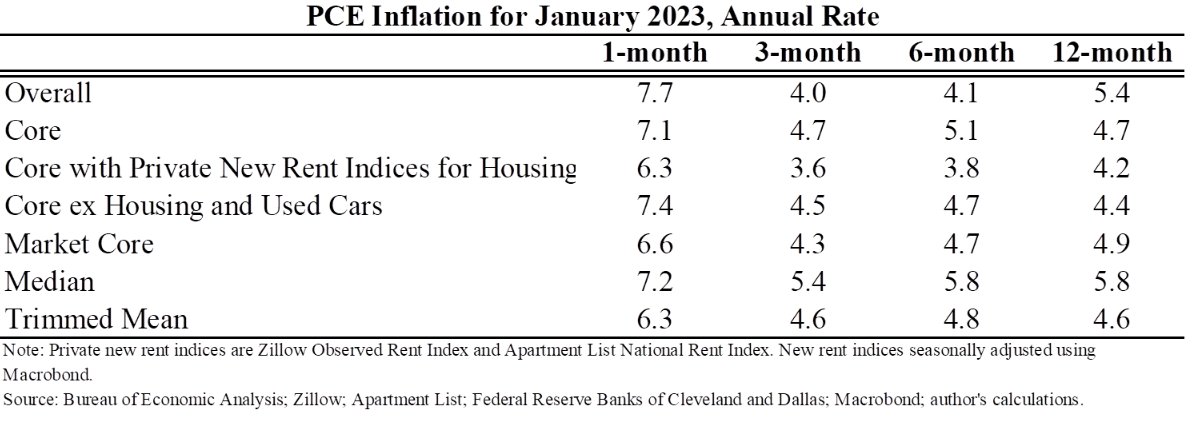

1. There are lots of measures of underlying inflation but most of them have a 4 in front of them. You have to be very confident in your models and predictions to think that will change a lot–especially in an economy where GDP for Q1 is tracking at a 3.2% annual rate.

So I continue to think the economy will need less demand over time to bring inflation back to something within range of the target, whether that is the Fed’s current 2% target or a de facto or de jure range that includes 3%.

2. A banking crisis is a bad way to lower demand. It’s nonlinear, could spiral in uncontrollable and long-lasting ways & result in high costs–some of which we’ve already seen w/ the ex post deposit insurance expansions being passed on to depositors & govt funds at risk.

3. In past episodes of financial turmoil the Fed cut rates. But in most of those cases inflation was fine & the rate cuts were justifiable based on the employment side of the mandate. In some cases those rate cuts may have been a mistake, spuriously derisking financial markets.

The Fed already has a hard enough job using one tool (interest rates) to achieve two goals (inflation and employment). Adding a third goal makes it even harder, especially when the Fed has other tools to advance that goal.

Most importantly, using interest rates aggressively for financial stability at a time like this could be counterproductive. Higher inflation/expected inflation would raise nominal bond yields and lower prices. And even more importantly…

…If the financial system gets a false sense of security about how much the FFR needs to rise to contain inflation that could cause even more accidents down the road. The FFR at the end of 2024 could be anywhere from 0% to 8%, financial system needs to be ready for any of those.

4. The Fed SHOULD take into account that the banking turmoil will tighten financial conditions, especially by reducing bank lending.This event should count as X bp of tightening–so the terminal rate should be whatever you thought before (in my case ~6%) – X.

The tricky thing is assessing what the X is. Most of the timely measures of financial conditions that we have are based on market prices. Those measures show that financial conditions have *loosened* slightly since the turmoil began, because yields & the dollar are both down.

Of course, those market-based measures are a poor guide to what is happening now, especially the widespread reports of credit pullbacks by banks, especially small and medium-sized banks. These are almost certainly large but really, really hard to quantify in real-time or at all.

I had been operating w/ a working assumption that when the dust settles this will all amount to the equivalent of 50bp of tightening. But that is a completely made up number and, so far, the dust is not coming close to settling. I’ve seen others (e.g., Torsten Slok) saying 150bp.

The Fed generally has better information than we do. When the most important info is in the CPI, employment report, etc., they have some advantage but not huge. When it is non-quantifiably spread throughout the banking system they may have an even larger informational advantage.

So where does that leave me? I lean towards 25bp, mostly because I still worry about demand & also about sending a falsely reassuring signal to financial markets about the future path. But I don’t feel strongly & if the Fed’s info leads them to 0bp I’ll likely update my views.

Vir: Jason Furman, twitter