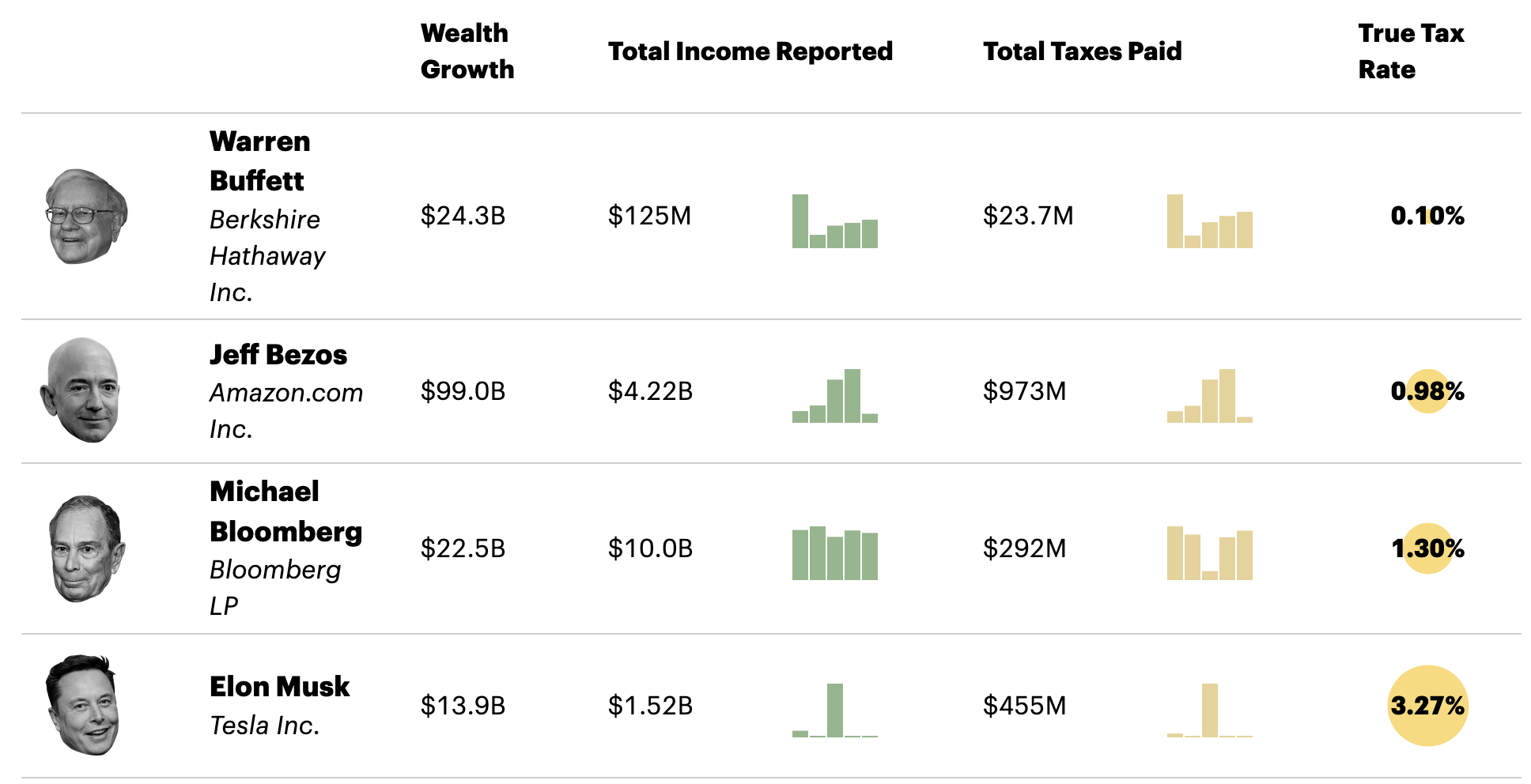

ProPublica je pred dnevi objavila prvo analizo podatkov iz davčnih napovedi 25 najbogatejših Američanov. Analiza kaže predvsem na to, da mit, da premožni plačujejo najvišje davke, niti slučajno ne drži. Velja seveda nasprotno, premožni plačujejo relativno nizke davke. V povprečju po stopnji 3.4%. Warren Buffet je v letih 2014-2018 plačal le 0.1% davka glede na porast premoženja, Jeff Bezos 1%, Elon Musk pa “visokih” 3.4%.

No, resnici na ljubo pri ProPublici malce mešajo jabolka in hruške ter davčne stopnje (napačno) izračunavajo glede na povečanje premoženja, ne pa na dejanske prihodke. Davek od dohodka se seveda plačuje glede na dohodke (plače, dividende itd.) in na kapitalske dobičke, slednji pa nastanejo seveda šele ob prodaji premoženja. To, da je Jeff Bezos med 2006 in 2018 povečal svoje premoženje za 127 milijard dolarjev, seveda ne pomeni, da je toliko tudi zaslužil. Kljub temu pa analiza kaže, da najbogatejši plačujejo zelo nizke davke tudi na izkazane dohodke, saj jim davčni sistem legalno omogoča, da znižajo davčno osnovo ali jo naredijo celo negativno (z upoštevanjem olajšav in kapitalskih izgub v posameznih letih). Denimo, Jeff Bezos je med 2006 in 2018 uradno prikazal za 6.5 milijard $ dohodkov, plačal pa le za 1.4 milijarde $ davka na te dohodke (stopnja 21.5%). Seveda zato, ker je uspel v posameznih letih prikazati zelo nizke dohodke ali celo izgube – leta 2011 je prikazal negativne dohodke zaradi izgub iz investicij ter dobil povrnjenih 4,000 dolarjev zaradi otroških olajšav.

Ameriški davčni sistem je pač narejen po meri premožnih. Velika večina prebivalstva, spodnjih 90% po dohodkih, prejema samo dohodke od dela, na katere plačujejo davke po veljavnih davčnih stopnjah. Premožnejši pa seveda uveljavljajo različne legalne luknje ali davčno ureditev, narejeno prav za premožne (denimo upoštevanje kapitalskih izgub za nazaj. Trumpu je denimo zaradi prikazane velike izgube uspelo naslednjih deset let plačevati nič davka na dohodke). Premožnješi pač z razlogom financirajo kampanje tako republikancev kot demokratov, da so jim naredili natanko tak davčni sistem in da ga seveda ne bi spremenili.

Pri nas se to seveda malce težje zgodi, saj naš davčni sistem pri osebnih davkih ne omogoča prenašanja izgub iz kapitalskih naložb iz preteklih let. Desničarji pač niso bili prav pogosto na oblasti, pa tudi premožnih, ki bi financirali kampanje posameznih strank, nimamo prav veliko.

Spodaj je nekaj zanimivih odlomkov iz članka v ProPublici.

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. The data provides an unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg. It shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.

Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more. In recent years, the median American household earned about $70,000 annually and paid 14% in federal taxes. The highest income tax rate, 37%, kicked in this year, for couples, on earnings above $628,300.

The confidential tax records obtained by ProPublica show that the ultrarich effectively sidestep this system.

America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.

To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

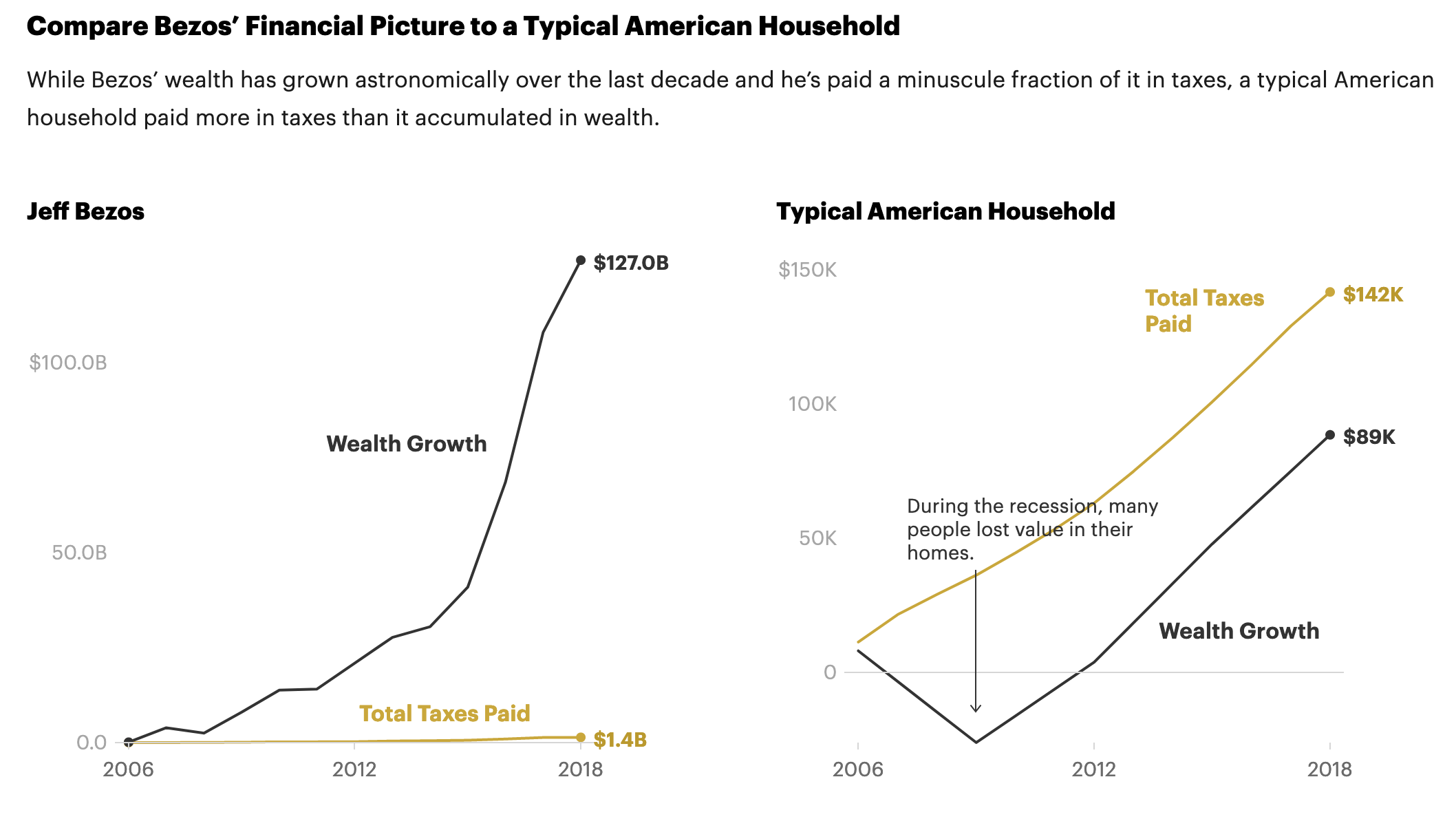

It’s a completely different picture for middle-class Americans, for example, wage earners in their early 40s who have amassed a typical amount of wealth for people their age. From 2014 to 2018, such households saw their net worth expand by about $65,000 after taxes on average, mostly due to the rise in value of their homes. But because the vast bulk of their earnings were salaries, their tax bills were almost as much, nearly $62,000, over that five-year period.

No one among the 25 wealthiest avoided as much tax as Buffett, the grandfatherly centibillionaire. That’s perhaps surprising, given his public stance as an advocate of higher taxes for the rich. According to Forbes, his riches rose $24.3 billion between 2014 and 2018. Over those years, the data shows, Buffett reported paying $23.7 million in taxes.

…

But few specifics about individuals ever emerge in public. Tax information is among the most zealously guarded secrets in the federal government. ProPublica has decided to reveal individual tax information of some of the wealthiest Americans because it is only by seeing specifics that the public can understand the realities of the country’s tax system.

Consider Bezos’ 2007, one of the years he paid zero in federal income taxes. Amazon’s stock more than doubled. Bezos’ fortune leapt $3.8 billion, according to Forbes, whose wealth estimates are widely cited. How did a person enjoying that sort of wealth explosion end up paying no income tax?

In that year, Bezos, who filed his taxes jointly with his then-wife, MacKenzie Scott, reported a paltry (for him) $46 million in income, largely from interest and dividend payments on outside investments. He was able to offset every penny he earned with losses from side investments and various deductions, like interest expenses on debts and the vague catchall category of “other expenses.”

In 2011, a year in which his wealth held roughly steady at $18 billion, Bezos filed a tax return reporting he lost money — his income that year was more than offset by investment losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit for his children.

His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.

Vir: ProPublica

You must be logged in to post a comment.