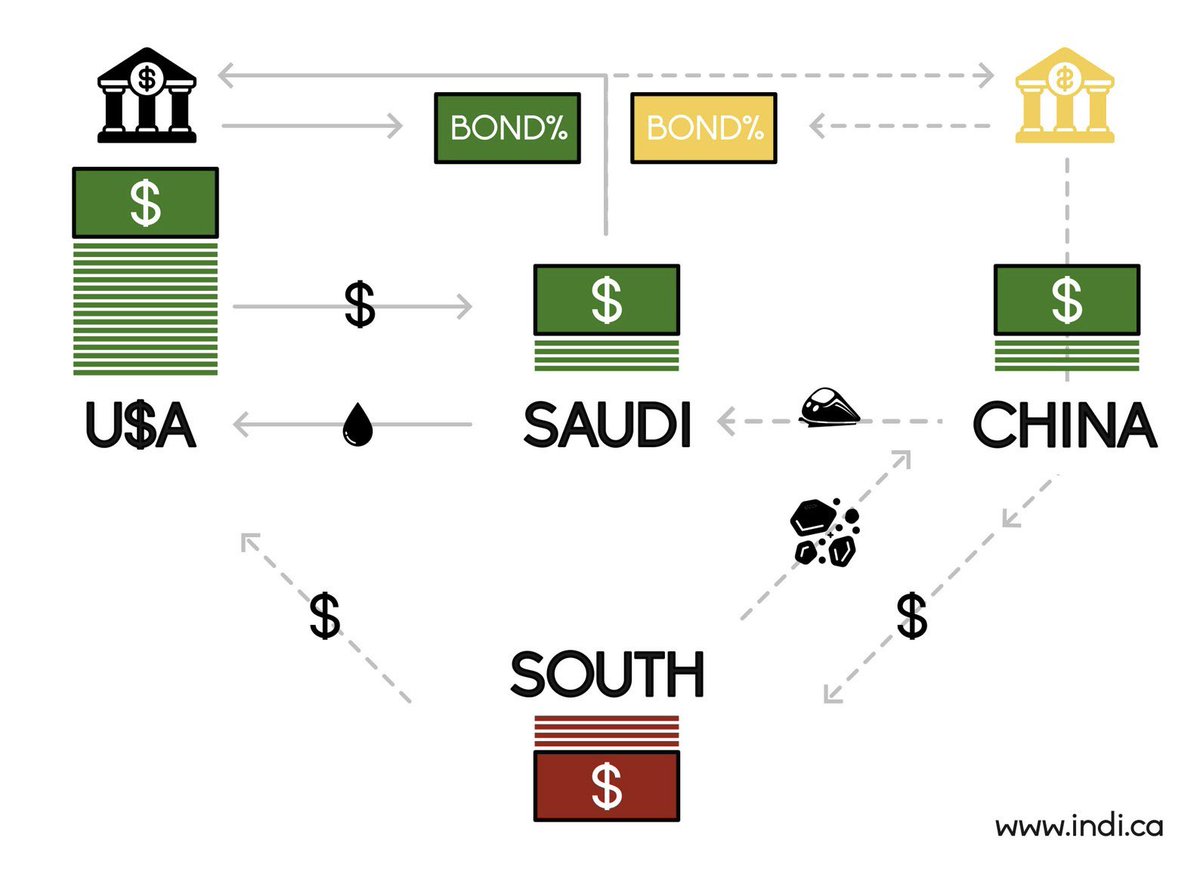

Če morda niste bili pozorni v prejšnjih dneh, ste spregledali novico, da je kitajska banka v Saudski Arabiji izdala obveznico, denominirano v dolarjih. Čeprav je šlo za izdajo majhne vrednosti (2 milijardi $), je zadeva zanimiva iz večih vidikov. Obveznica je denominirana v dolarjih, povpraševanje je bilo 20-krat večje od vrednosti izdaje, obrestna mera je bila zgolj za dlako (1-3 bazične točke) višja kot pri ameriških državnih obveznicah (Nemčija plačuje 10-20 bazičnih točk več za svoje obveznice) in odpira vprašanje, kaj želi Kitajska s tem doseči ter kaj sporoča ZDA in svetu. Ena izmed razlag je, da Kitajska s tem Ameriki sporoča, da se lahko zadolžuje po isti obrestni meri kot ZDA in da lahko ustvari paralelni dolarski finančni sistem, na drugi strani pa državam globalnega juga sporoča, da jim – če imajo težave pri refinanciranju dolga po bistveno višjih obrestnih merah – pomaga s cenejšim denarjem v zameno za izvoz surovin in jih s tem še bolj naveže na svoj trgovinski in finančni sistem. Kitajska s tem signalizira, da lahko zruši monopol ameriškega finančnega sistema in ustvari večjo dovisnost držav globalnega juga od Kitajske.

Spodaj sta dve zanimivi razlagi. Z nobeno se ni treba strinjati, splača pa se ju vzeti na znanje. Najprej Arnaud Bertrand:

At first glance, the mechanics are straightforward: China issued bonds, denominated in US dollars, that investors eagerly snapped up. The bonds were oversubscribed nearly 20 times, with over $40 billion in demand for just $2 billion in bonds. This level of interest dwarfs the typical 2-3x oversubscription seen in US Treasury auctions.

Even more striking is the interest rate. China secured rates just 1-3 basis points (0.01-0.03%) higher than US Treasuries—essentially matching the borrowing cost of the US government. For perspective, even AAA-rated countries like Germany or Japan typically pay at least 10-20 basis points above US Treasuries when issuing USD bonds.

The venue for this issuance—Riyadh—adds another layer of intrigue. Sovereign bonds are typically issued in established financial hubs like London or New York, not in the heart of the petrodollar system. By choosing Saudi Arabia, China appears to be subtly challenging the status quo, showcasing itself as an alternative player in the global dollar ecosystem.

A Subtle Signal to Washington

The timing and nature of this bond issuance seem less about financial necessity and more about strategic signalling. By successfully issuing dollar-denominated bonds in Saudi Arabia, China demonstrates it can compete directly with US Treasuries as a destination for dollar investments.

For decades, the US has enjoyed an “exorbitant privilege,” with countries like Saudi Arabia recycling their surplus dollars into US Treasury bonds, effectively subsidising US government spending. Now, China is introducing a rival option. The bonds give countries like Saudi Arabia an alternative, enabling them to park their dollar reserves with Beijing instead of Washington.

You must be logged in to post a comment.