Revija Nature je objavila članek, kjer poskuša revidirati evropski Green Deal, gelde na yo, da so se okoliščine po njegovem sprejemu bistveno spremenile. Specifično, avtorji pravijo, (1) predpostavka, da bodo vse države sodelovale pri uvedbi ogljičnega davka se ni uresničila, izvaja ga samo EU; (2) po začetku energetske krize in izbruha inflacije so se obrestne mere zelo povečale, javni dolgovi držav pa se po pandemiji in energetski krizi močno povečali, in (3) geopolitična situacija se je zaradi geostrateške tehnološke vojne drastčno spremenila – Kitajska in ZDA subvencionirata razvoj novh “čistih” tehnologij, ki pa so v osnovi zelo umazane (proizvodnja baterij in panelov ter proizvodnja energije za njihovo proizvodnjo), medtem ko se EU foikusira brezogljične cilje in v procesu z visokimi ofljičnimi davki in cenami energije ubija konkurenčnost svoje industrije. Nature:

The Green Deal was predicated on three presumptions, each of which has not been borne out.

First, it was widely expected that a global carbon tax would emerge, and it has not. Most economists view carbon taxation as the optimal policy for pushing carbon-intensive industries to lower their emissions2. Carbon taxes also bring in revenue to help finance the green transition. Yet Europe now stands alone in implementing carbon pricing on a large scale.

…

However, most countries worldwide do not levy carbon taxes. And those that do put a relative value of at most a few dollars on each tonne of emitted carbon dioxide equivalent, once they have corrected for the many firms that are exempted. That low value doesn’t reflect the real damage done, now and in the future — the ‘social cost of carbon’3.

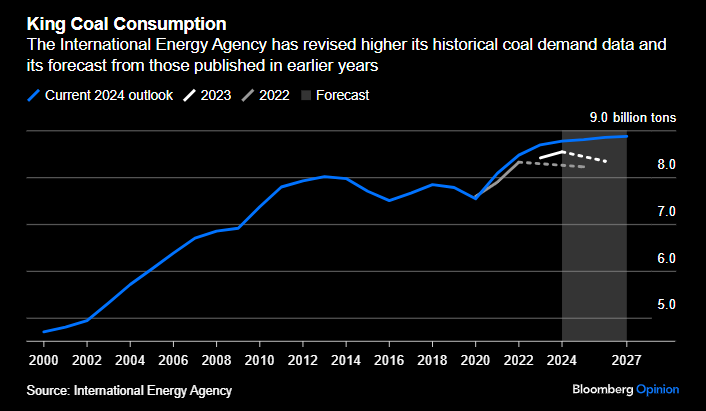

Why has carbon taxation not taken off? International coordination of climate policies has fallen victim to geopolitical fragmentation and technological rivalry. The United States and China are competing fiercely over green technologies — each has issued massive subsidies for research and development (R&D) and manufacturing in areas such as batteries, solar panels and wind power.

…

Second, the Green Deal was designed and adopted at a time when long-term interest rates were historically low or even negative in real terms, and when levels of public debt were moderate. These economic conditions were conducive to financing the massive investments necessary to accomplish the transition to net zero, especially electrification. The aim was also to extend financial support to help European populations to bear the early costs of the green transition4.

However, the post-pandemic environment is very different. Public debt as a percentage of gross domestic product (GDP) has soared in most advanced and European economies to more than 80%, on average. Greece, Italy, France, Spain and Belgium have public-debt-to-GDP ratios of more than 100%. This will limit the possibilities for helping households to absorb the costs of the transition, and will force careful selection of public and green investments.

Third, geopolitical trends challenge the Green Deal. As currently designed, the deal impedes European competitiveness by increasing the cost of energy substantially, mainly to cover the cost of building infrastructure around renewables and decommissioning those around fossil fuels. Europe also depends heavily on external suppliers for ‘critical minerals’ — sources of elements such as lithium and cobalt — for renewable energy and other green technologies.

Like the United States, Europe is facing challenges from China — which has control of 60–80% of the world’s production and processing of critical minerals. China is also the biggest emitter of CO2, the largest producer of coal-based electricity and the world leader in batteries and electric vehicles. China’s strategy is to act as a monopolist with low pricing, undercutting others.

Nadaljujte z branjem→