China’s Rare Earth Refining at 5N (99.999%) Purity Is the Moat the U.S. Can’t Cross

By any strategic measure, China’s grip on the rare earth supply chain is not just dominant—it’s nearly unassailable. With 83% of global rare earth refining capacity and 92% of the world’s magnet production, Beijing has built a fortress around one of the most critical inputs to modern technology. But it’s not just the volume—it’s the purity that defines the moat.

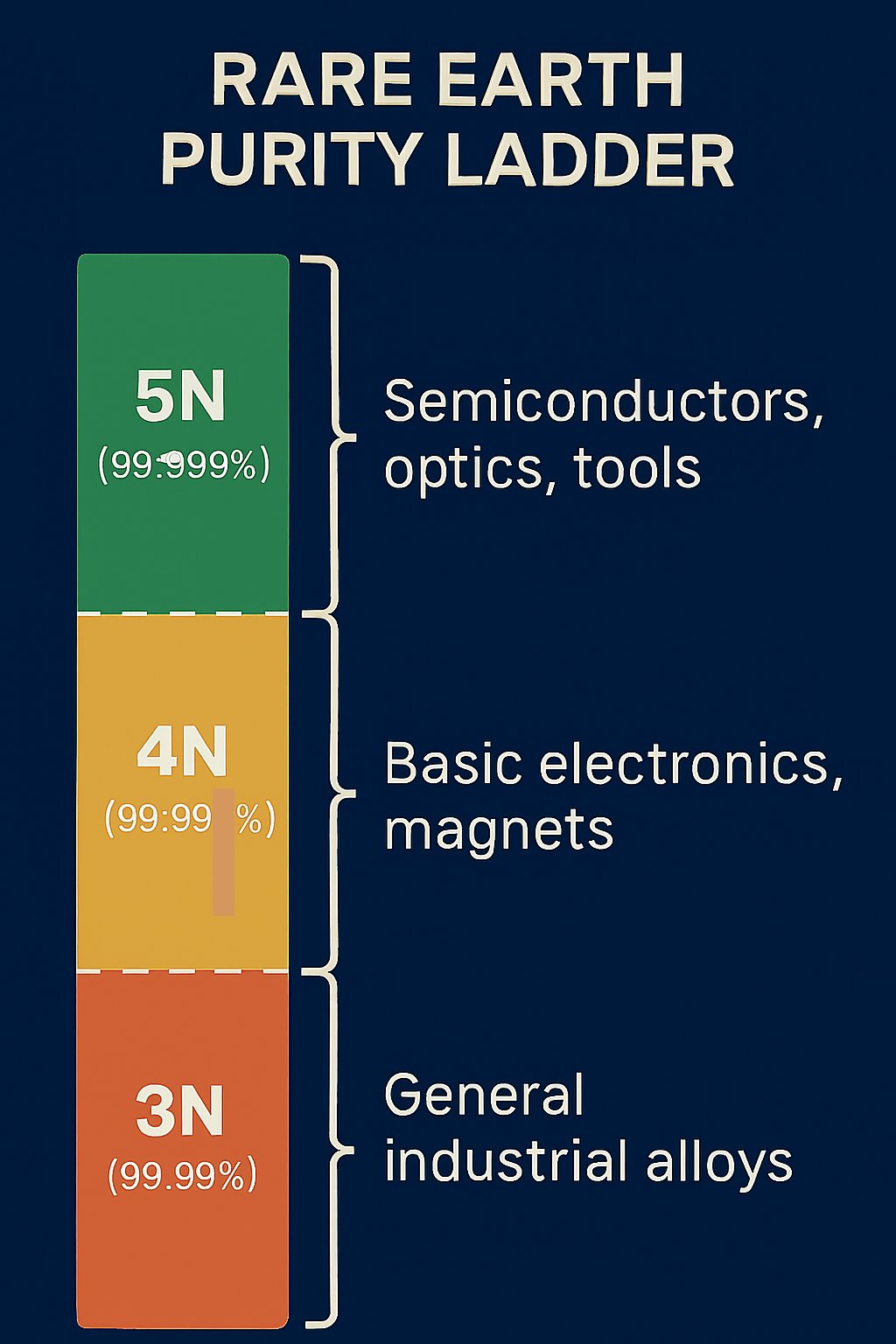

China is the only country that achieves 5N purity (99.999%) in rare earth refining. This ultra-high standard is not a luxury—it’s a necessity for the semiconductor and precision tool industries. At 3N or 4N purity, rare earth oxides may suffice for wind turbines or electric vehicles. But in the world of AI chips, EUV lithography, and atomic-scale etching, even trace impurities can sabotage performance, reliability, and yield.

The Semiconductor Dependency

Semiconductor fabs like TSMC, Intel, and Samsung rely on rare earths for:

*High-k metal gate dielectrics: Lanthanum and neodymium oxides must be ultra-pure to prevent charge trapping and leakage.

*Sputtering targets: Used in thin-film deposition, where uniformity and defect control are paramount.

*Precision motors and optics: Rare earth magnets and dopants power the lithography stages and laser systems that define sub-5nm nodes.

Without 5N purity, these systems degrade. And without China’s refining infrastructure, the global supply chain falters.

The Toolmaker Trap

Companies like ASML, Tokyo Electron, and Applied Materials are equally exposed. Their tools contain rare earth magnets, coatings, and dopants that require ultra-pure inputs. Even if the tools are assembled in Europe or the U.S., the rare earths often originate in China. And under new MOFCOM rules,*—a bureaucratic chokehold on the entire ecosystem.

Why the U.S. Can’t Cross the Moat

The U.S. has rare earth reserves. It even has mining operations. But it lacks:

*Refining infrastructure: No domestic facility can match China’s scale or purity.

*Solvent extraction expertise: China’s multi-stage separation techniques are proprietary and decades ahead.

*Vertical integration: From mine to magnet, China controls every link. The U.S. outsources most steps.

*Environmental tolerance: China’s refining process is dirty, and its regulatory leniency gives it an edge the West won’t match.

Even Japan and Australia—technologically advanced and resource-rich—struggle to scale beyond 3N or 4N purity. The U.S. faces the same bottlenecks, compounded by geopolitical friction and fragmented industrial policy.

Strategic Consequences

China’s rare earth moat is not just economic—it’s geopolitical. It gives Beijing leverage over:

- AI and defense chips

- Quantum computing

- Advanced manufacturing

- Clean energy systems

In a world increasingly defined by technological sovereignty, the ability to refine rare earths to 5N purity is not just a technical achievement—it’s a strategic weapon.

Unless the U.S. can build a vertically integrated, environmentally sustainable, and purity-competitive rare earth ecosystem, it will remain dependent on China’s moat. And in the semiconductor arms race, dependency is vulnerability.

Vir: Ignis Rex

You must be logged in to post a comment.