Prve modelske ocene kažejo, da bo zaradi uvedbe Trumpovih carin, ameriški BDP v vsakem primeru upadel. Samo Kanada in Mehika bi doživeli večji šok od ZDA. S tem, da naj bi ameriški BDP upadel bolj (za 1.4 %), če bodo prizadete države uvedle povračilne carine (v isti višini), kot pa če ne bi reagirale (takrat bi upadel za 0.5 %). Do tega pride, ker bodo carine udarile tudi po uvozu izdelkov, ki jih ameriška podjetja prek različnih aranžmajev proizvajajo širom sveta in nato uvažajo nazaj, zato se bodo ti izdelki podražili in zmanjšala se bo njihova prodaja. Učinek bo ustrezno večji, če druge države uvedejo povračilne ukrepe, ker bodo s tem prizadeti tudi ameriški izvozniki.

Pomembna ugotovitev teh modelskih ocen je, da se EU mora maščevati z uvedbo zaščitnih carin, da bi se izognila upadu BDP. V primeru, da ne bi uvedla povračilnih carin, bi BDP EU upadel za 0.3 %, če pa bi jih uvedla, pa bi to nevtraliziralo šok Trumpovih carin in se BDP ne bi spremenil.

Pomembno je še, da bo zaradi globalne trgovinske vojne, ki jo je sprožil Trump, prizadeto celotno globalno gospodarstvo – globalni BDP naj bi upadel za med 0.26 % (brez povračilnih carin) in 0.43 % (s povračilnimi carinami). To je standardni nauk iz zunanje trgovine – trgovinska vojna je slaba za vse države. In bolj kot se zaostruje in bolj kot se znižuje medsebojna trgovina, večja je škoda (v obliki upada BDP, delovnih mest, koristi za potrošnike itd.). V končni instanci – če pride do popolnega prenehanja trgovanja (avtarkija), nobena država ne more izkoriščati svojih primerjalnih prednosti in se specializirati, zato je splošna učinkovitost gospdarstva nižja.

Toda komu to govorimo? Trump je zadnja oseba, ki bi prisluhnila agumentom.

____________

We now have a clearer picture of Donald Trump’s “Liberation Day” tariffs and how they will affect other trading nations, including the United States itself.

The US administration claims these tariffs on imports will reduce the US trade deficit and address what it views as unfair and non-reciprocal trade practices. Trump said this would

forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed.

The “reciprocal” tariffs are designed to impose charges on other countries equivalent to half the costs they supposedly inflict on US exporters through tariffs, currency manipulation and non-tariff barriers levied on US goods.

…

GDP impacts with retaliation

Other countries are now likely to respond with retaliatory tariffs on US imports. Canada (the largest destination for US exports), the EU and China have all said they will respond in kind.

To estimate the impacts of this tit-for-tat trade standoff, I use a global model of the production, trade and consumption of goods and services. Similar simulation tools – known as “computable general equilibrium models” – are widely used by governments, academics and consultancies to evaluate policy changes.

The first model simulates a scenario in which the US imposes reciprocal and other new tariffs, and other countries respond with equivalent tariffs on US goods. Estimated changes in GDP due to US reciprocal tariffs and retaliatory tariffs by other nations are shown in the table below.

The tariffs decrease US GDP by US$438.4 billion (1.45%). Divided among the nation’s 126 million households, GDP per household decreases by $3,487 per year. That is larger than the corresponding decreases in any other country. (All figures are in US dollars.)

Proportional GDP decreases are largest in Mexico (2.24%) and Canada (1.65%) as these nations ship more than 75% of their exports to the US. Mexican households are worse off by $1,192 per year and Canadian households by $2,467.

Other nations that experience relatively large decreases in GDP include Vietnam (0.99%) and Switzerland (0.32%).

Some nations gain from the trade war. Typically, these face relatively low US tariffs (and consequently also impose relatively low tariffs on US goods). New Zealand (0.29%) and Brazil (0.28%) experience the largest increases in GDP. New Zealand households are better off by $397 per year.

Aggregate GDP for the rest of the world (all nations except the US) decreases by $62 billion.

At the global level, GDP decreases by $500 billion (0.43%). This result confirms the well-known rule that trade wars shrink the global economy.

GDP impacts without retaliation

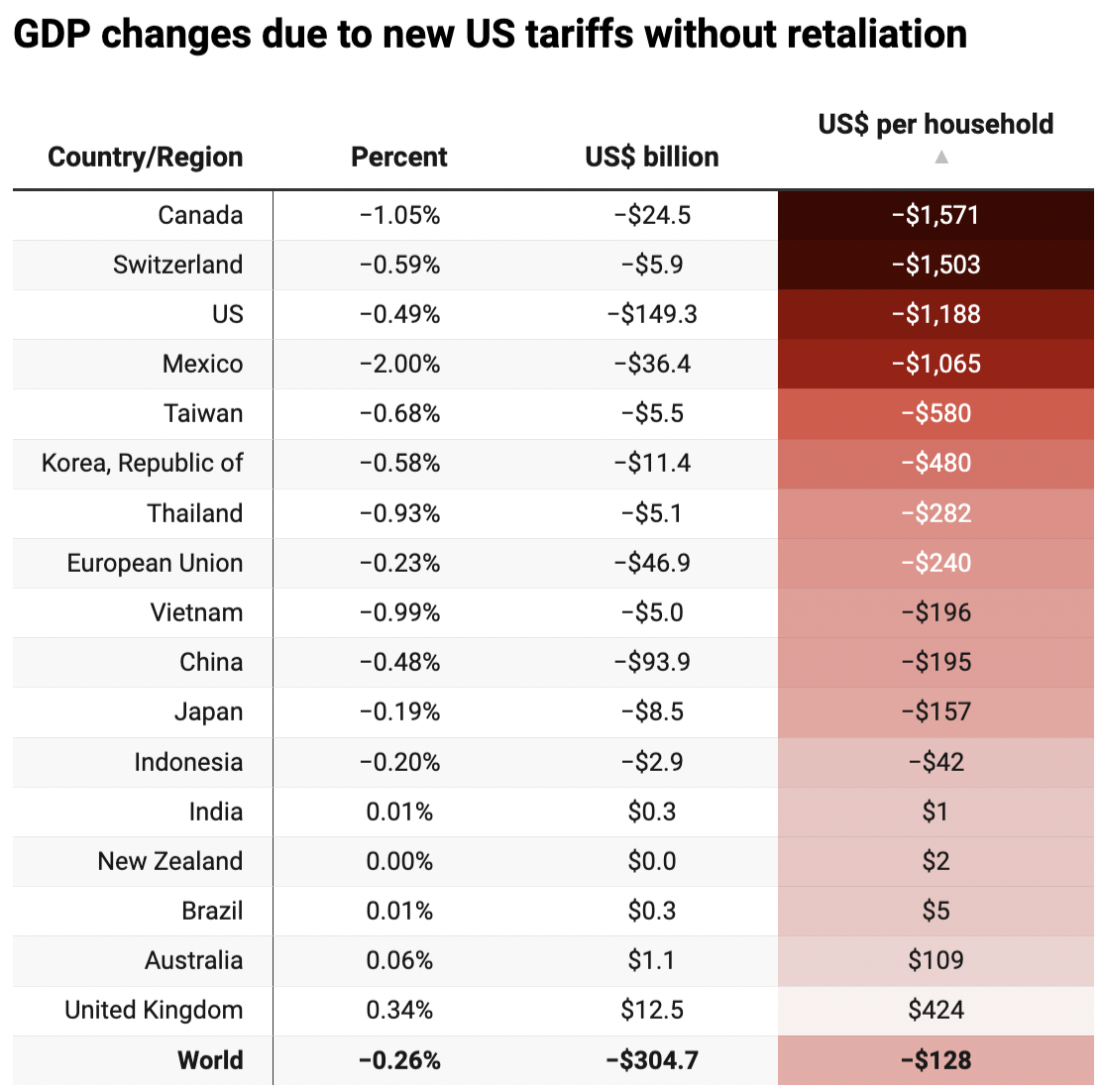

In the second scenario, the modelling depicts what happens if other nations do not react to the US tariffs. The changes in the GDP of selected countries are presented in the table below.

Countries that face relatively high US tariffs and ship a large proportion of their exports to the US experience the largest proportional decreases in GDP. These include Canada, Mexico, Vietnam, Thailand, Taiwan, Switzerland, South Korea and China.

Countries that face relatively low new tariffs gain, with the UK experiencing the largest GDP increase.

The tariffs decrease US GDP by $149 billion (0.49%) because the tariffs increase production costs and consumer prices in the US.

Aggregate GDP for the rest of the world decreases by $155 billion, more than twice the corresponding decrease when there was retaliation. This indicates that the rest of the world can reduce losses by retaliating. At the same time, retaliation leads to a worse outcome for the US.

Previous tariff announcements by the Trump administration dropped sand into the cogs of international trade. The reciprocal tariffs throw a spanner into the works. Ultimately, the US may face the largest damages.

Vir: The Conversation

Dvomim da so Trump in njegovi svetovalci tako neumni, da vsega tega ne bi vedeli. Trump je že v predvolilni tekmi obljubil, da bo vrnil proizvodnjo domov. Visoke carine so temu namenjene. Poleg tega želi z visokimi tarifami vplivati na znižanje uvoznih carin na ameriške izdelke. Kot kaže njegov drastičen ukrep že deluje, nekatere države so že napovedale brezcarinsko trgovanje z ZDA ali pa so se pripravljene o tem pogovarjati, medtem ko je več podjetij napovedalo velika vlaganja v ZDA, oziroma odprtje proizvodnje v ZDA, da bi se izognili davkom.

https://www.armstrongeconomics.com/international-news/trade-war/trumps-tariffs-are-winning/

Všeč mi jeVšeč mi je