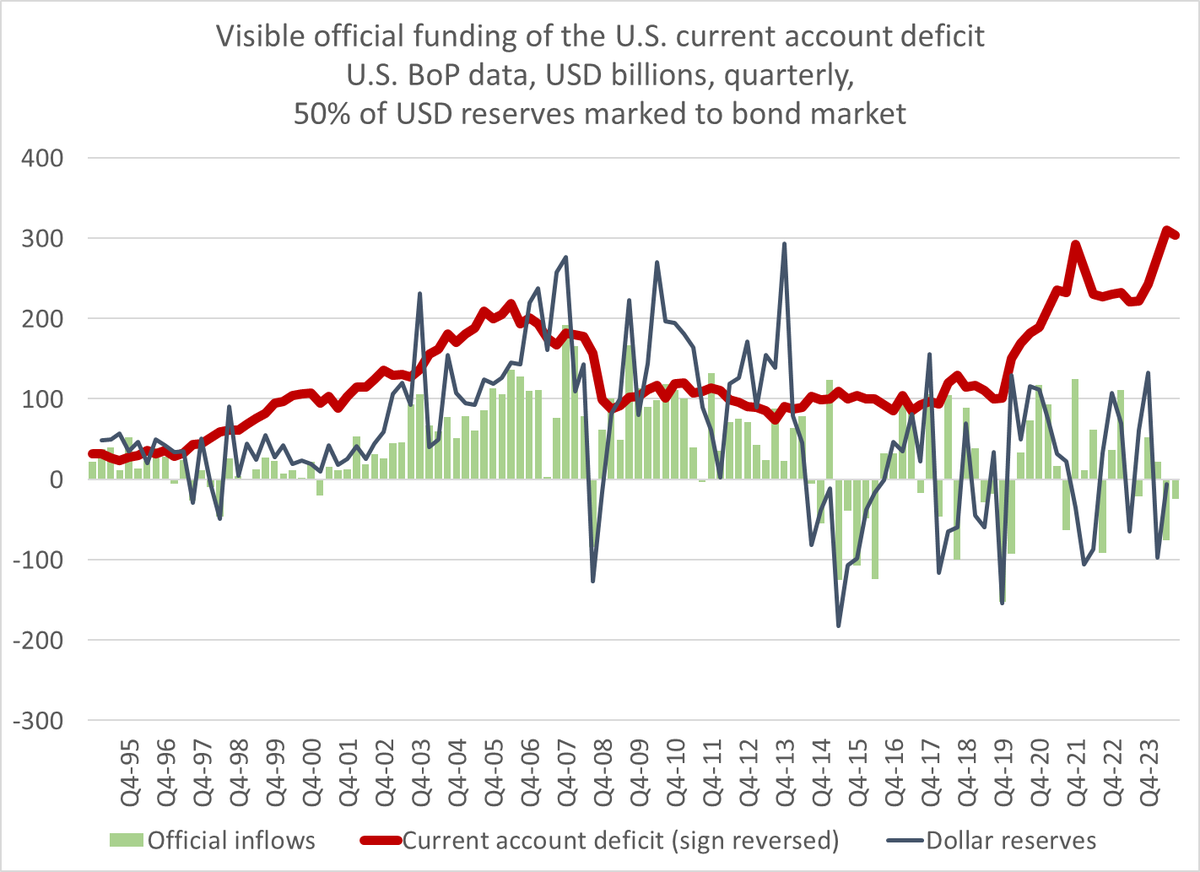

The current discussion of a Mar-a-Lago accord presumes substantial inflows into US financial assets from governments seeking to hold safe global assets —

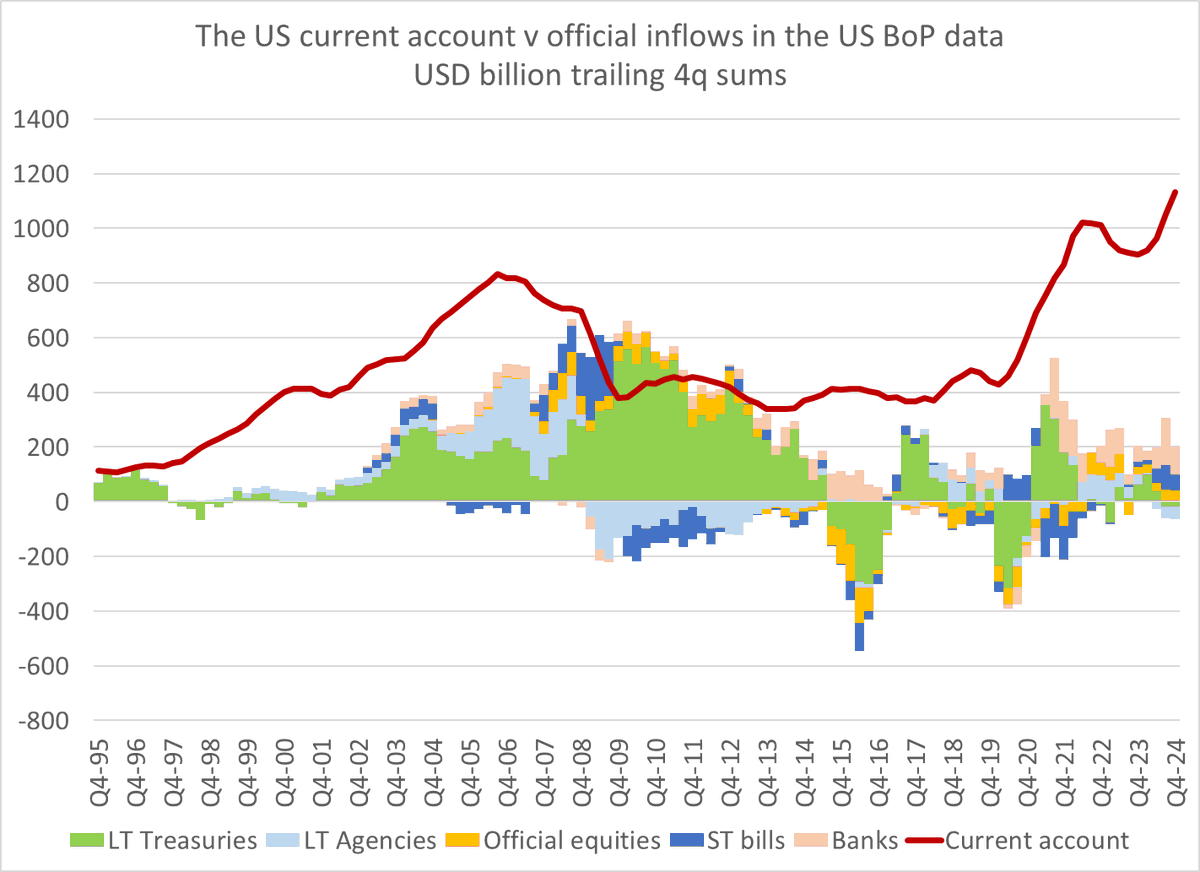

But there were no such flows in the US balance of payments in the fourth quarter.

And the fourth quarter isn’t an outlier — the runup in the US current account deficit in 2024 (please take note @IMFNews) was financed privately, official (official = foreign central bank and SWF) demand for US assets was modest!

@IMFNews Miran thinks of inelastic demand for safe dollar assets (“reserves”) as coming from private as well as official actors (tho hard to see how private actors get coerced into 100 year zeros … ) but right now the bond inflow into the US isn’t coming from formal reserves.

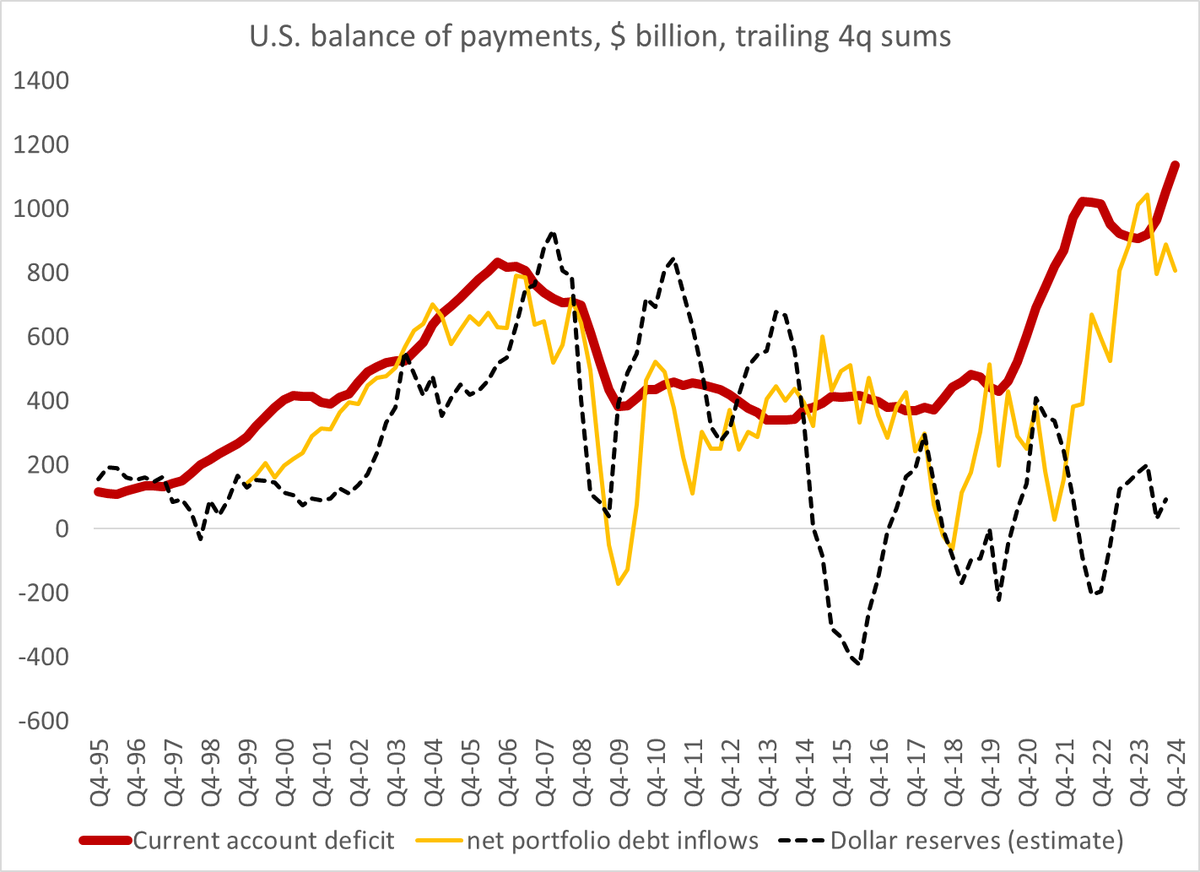

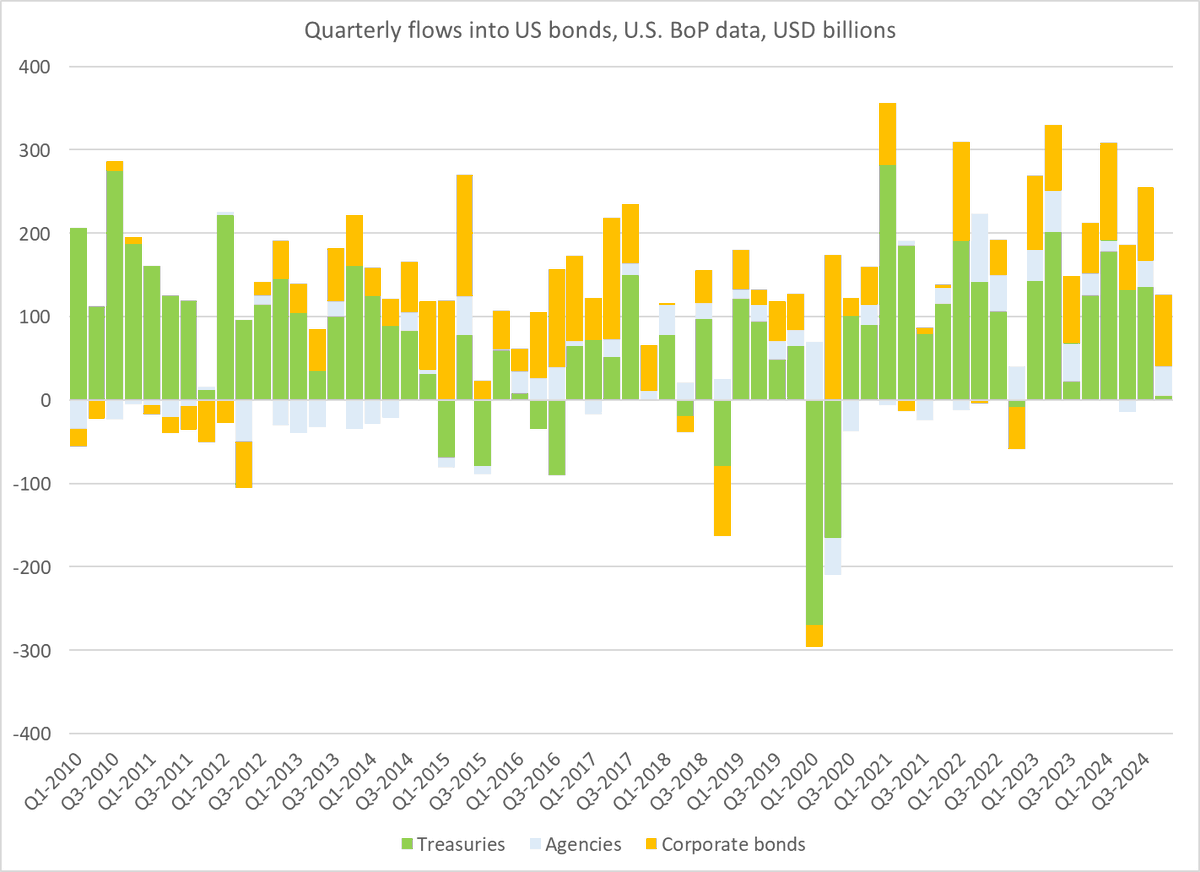

@IMFNews Well then now is the US external deficit being funded — well, in aggregate, still mostly through bond inflows, just not bond inflows that come directly from Japan or China. And with decent demand for higher yielding US corporate debt …

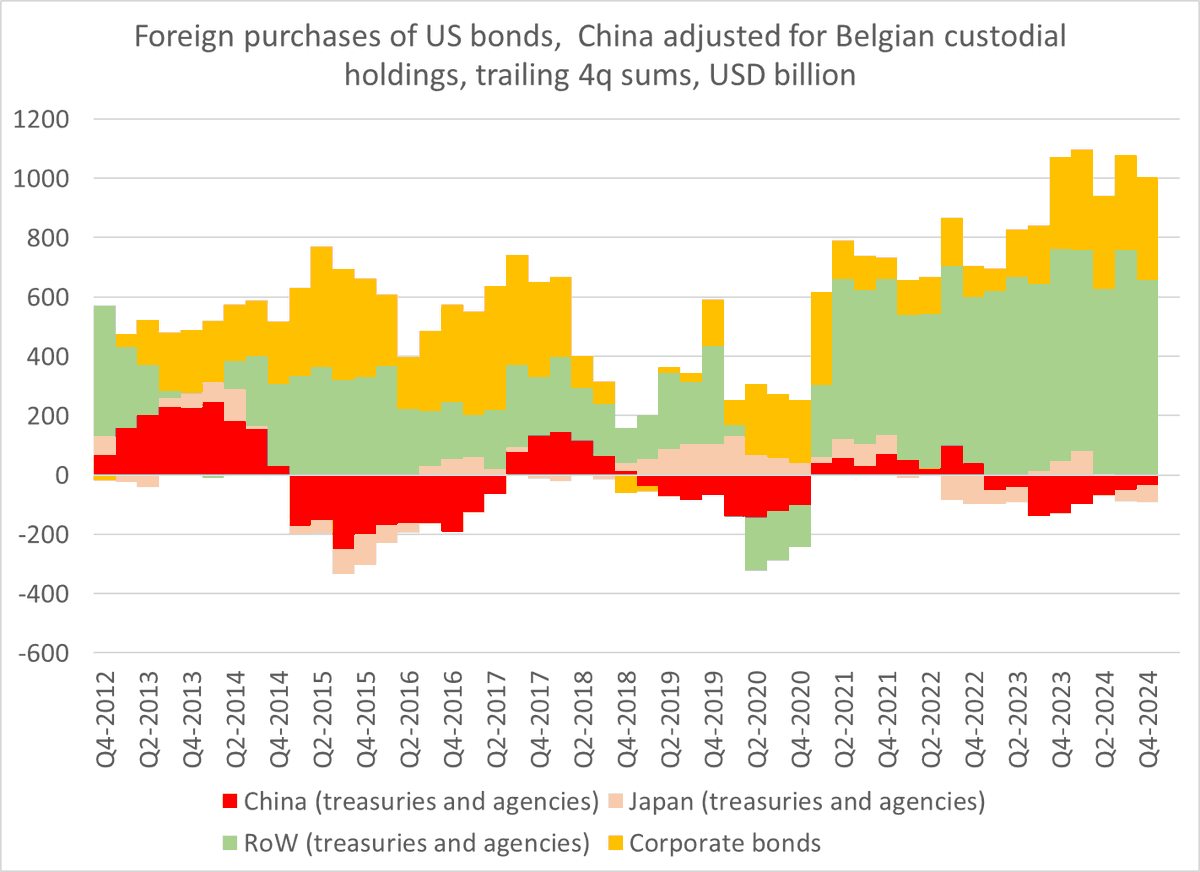

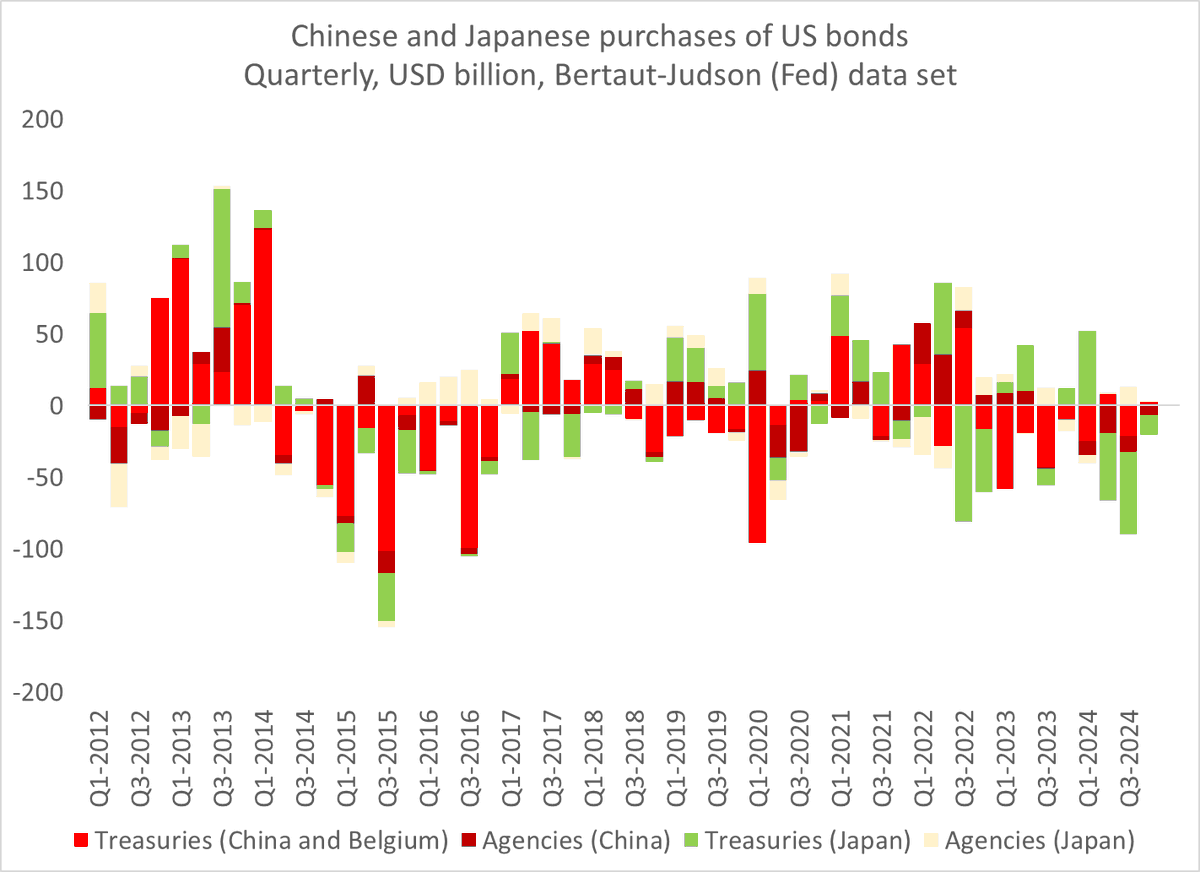

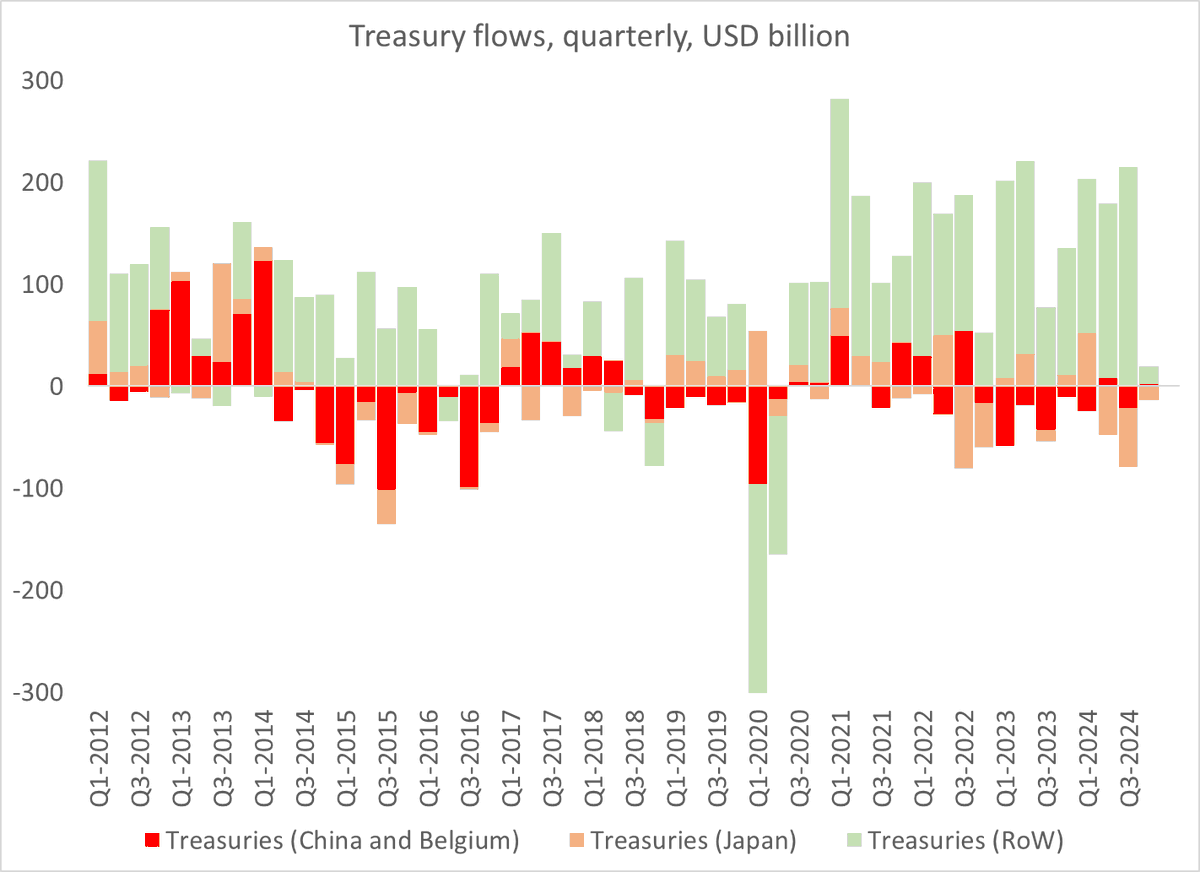

In fact, the US data doesn’t show any real demand for safe US assets from China or Japan over the last few years, which runs a bit against the Miran thesis (obviously there were important changes in the hedge ratio in Japan than helped push the dollar up v the yen)

I don’t make too much of the fall off in foreign demand for long-term Treasuries in q4, as the January data was stronger — but Treasury inflows were on the low side, and if there is more talk about Treasuries being forcefully termed out, that might turn into a trend

As the financing of the US external deficit shifted from official actors recycling reserves bought to keep their currencies from appreciating to private investors looking for yield, there also has been more total demand for US corporate bonds — that was the case in q4

Bottom line: we are in an era where private investors looking for yield + equity investors chasing US outperformance drove up the dollar and the US external deficit; official (price inelastic) flows have been quite low just at a time when they have gotten new prominence

Vir: Brad Setser