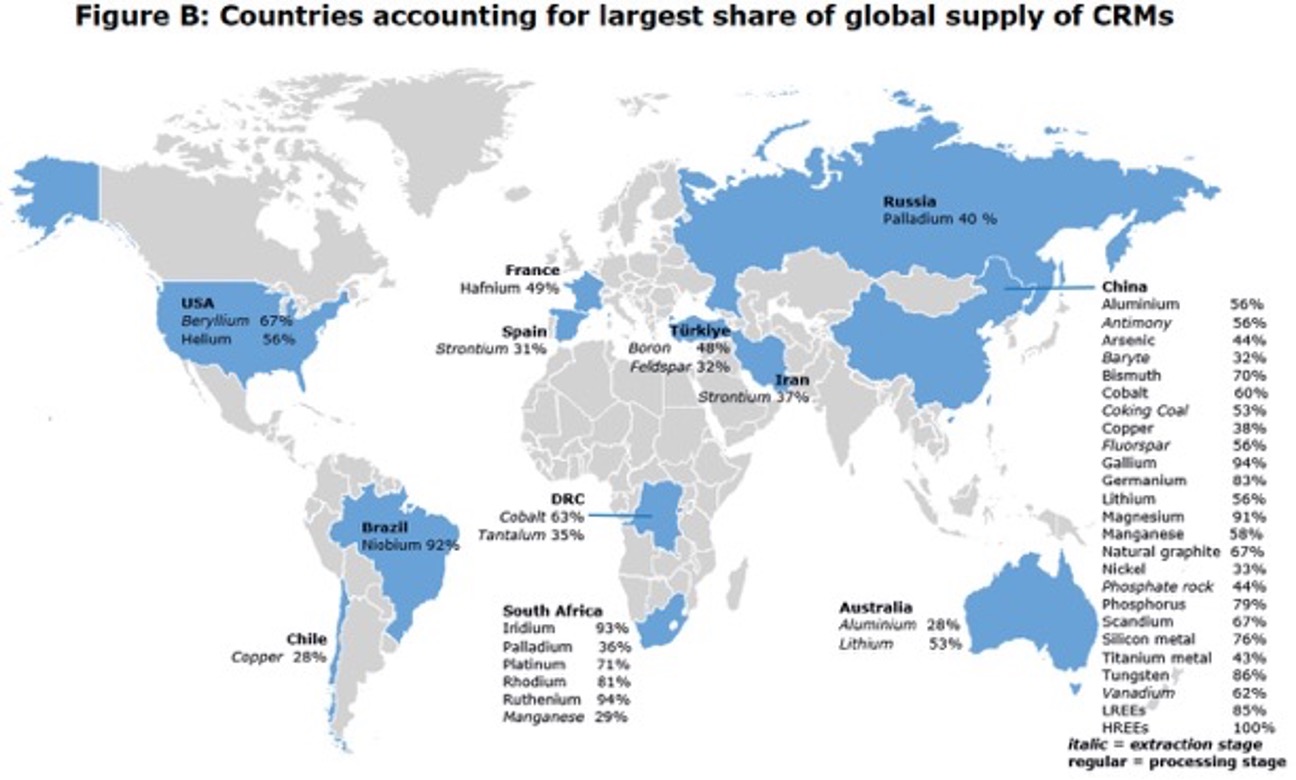

ZDA in Evropa sicer načeloma lahko z visokimi carinami, tehnološkimi sankcijami in prepovedjo uvoza (vsaj delno) zaustavijo neposredni uvoz kitajskih high tech izdelkov. Toda kitajski odgovor je precej bolj subtilen in učinkovit. Kitajska ne samo, da kontrolira proizvodnjo med 67 in 80 % vseh komponent in končnih izdelkov t.i. čistih tehnologij (sončni paneli, baterije, vetrnice, elektrolizerji in komponente zanje), ki jih v zahodnem svetu potrebujemo za razogljičenje, pač pa kontrolira tudi dobavne verige v obsegu 60 do 100 % vseh ključnih materialov za sodobno high tech industrijo. Spodnja slika kaže globalni delež Kitajske pri ponudbi kritičnih materialov (critical raw materials, CRM). Slike so iz šestega poročila Evropske komisije o CRM.

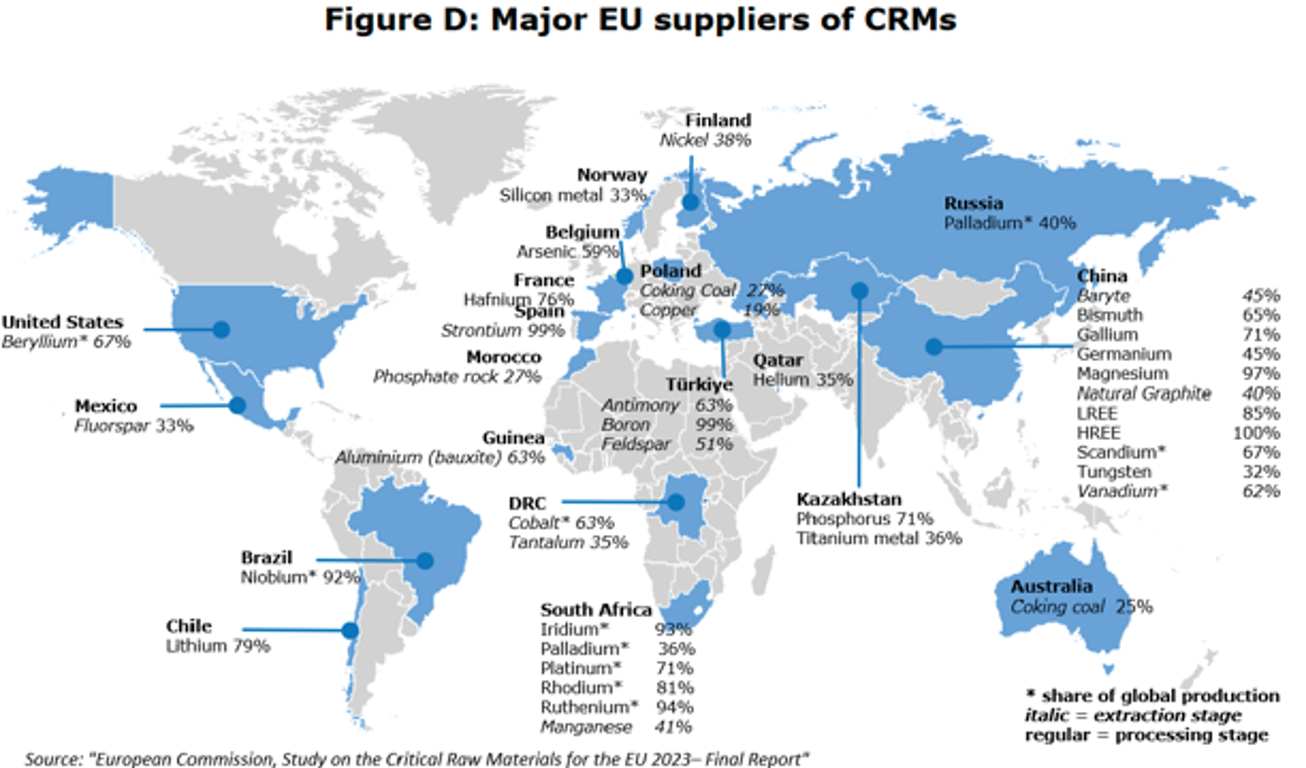

Kot kaže spodnja slika, je Evropa med 32 in 100 % odvisna od uvoza iz Kitajske pri ključnih kritičnih materialih, pri mineralih redke zemlje med 85 in 100 %, pri germaniju 45 % in galiju 71 % (slednji uradni podatki EK se zdijo nekoliko prenizki, glede na to, da Kitajska kontrolira 98 % globalne proizvodnje galija in 60 % proizvodnje germanija).

No, ko so ZDA prepovedale izvoz čipov in tehnologije zanje v Kitajsko in ko je Evropska komisija napovedala uvedbo carin na uvoz električnih avtomobilov, se je Kitajska odzvala zelo elegantno: naznanila je prepoved galija in germanija. S čimer je prizadela tako evropsko kot ameriško high tech industrijo. Spodaj je dobra nit, kako lahko ta prepoved izvoza prizadene zahodno high tech industrijo, predvsem proizvodnjo polprevodnikov, letalsko in telekomunikacijsko industrijo.

Ko se otroci (zahodni politiki) igrajo z vžigalicami (Kitajsko)… nimajo pojma, s čim se igrajo.

____________

China’s export bans on Gallium & Germanium 🚨

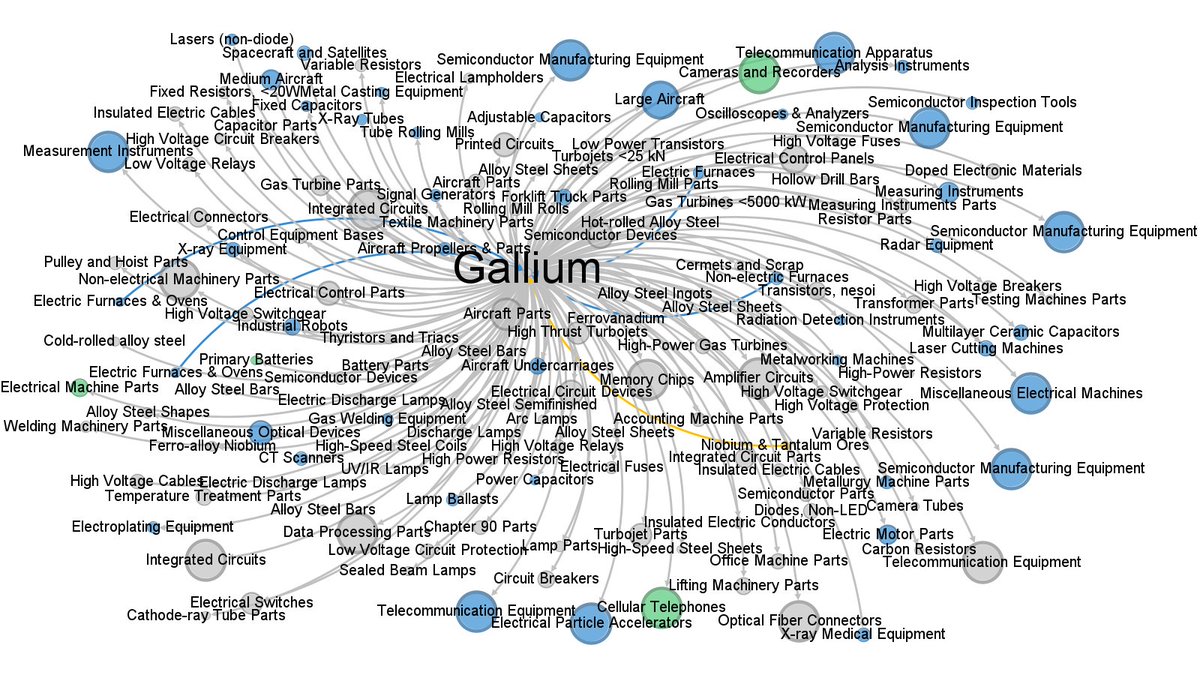

Why it matters: Gallium is central to countless downstream industries: semiconductors, aerospace, telecommunications, & more. This image shows how interconnected it is.

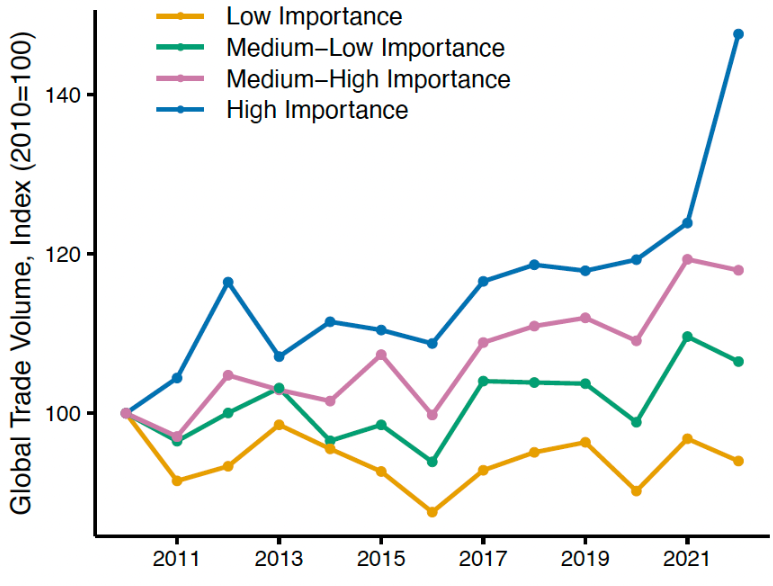

Public data, method & our paper in thread 🧵Each node is a product. Size of node based on how “important” or “central” product is in international trade. Blue nodes are capital goods, silver are intermediates and green are final consumption good.

In our paper, AI-Generated Production Networks (2024), joint with with @fetzert, @pj_lambert and @bennetlf, we used AI to build AIPNET, a detailed map of global production networks.

It shows how critical materials like Gallium & Germanium underpin industries worldwide—and the disruptions export bans can cause.Why AIPNET? Global trade relies on complex relationships between >5,000 products. Mapping these with traditional methods is slow. We built AIPNET using AI, which connects products like Gallium to their downstream uses. Here’s what we found 👇

Trend 1: Global trade is shifting toward upstream & intermediary goods—like Gallium—are becoming central. Countries are focusing on inputs critical to supply chain resilience. Gallium isn’t alone. AIPNET shows rising importance of:

1. Digital integrated circuits 🖥️

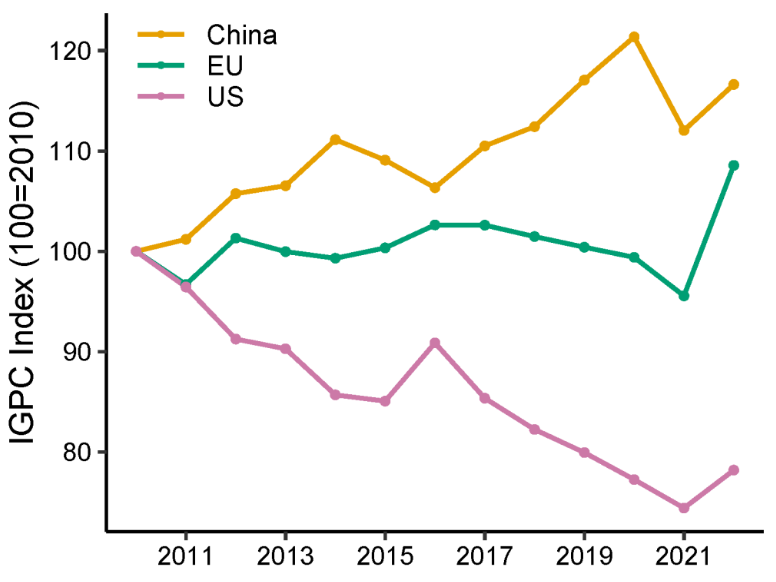

2. Lithium compounds 📷products.CapitalTrend 2: Diverging strategies of U.S. vs. China in global trade. China: Importing more upstream products like Gallium to build advanced domestic industries. US: Importing more downstream goods, relying on global supply chains.

Why This Matters China’s dominance in Gallium (98% of global production) is a prime example of its leverage. Export bans on Gallium/Germanium disrupt entire supply chains, with ripple effects across semiconductors, defence, & tech. They are immediately scarce (China accounts for over 98% of global gallium production and about 60% of germanium production) but they are not inherently scarce. Some immediate alternative sources do exist, especially for germanium. Onshoring this production would take time.

China’s recent export ban on gallium and germanium to the U.S. underscores the fragility of global supply chains. For instance, U.S. Geological Survey estimates that a complete ban could reduce U.S. GDP by $3.4 billion (see https://doi.org/10.3133/ofr20241057)

For context, this move is a direct response to U.S. export controls on semiconductor technology to China. Such escalating tit-for-tat measures highlight the urgent need for nations to reassess their supply chain dependencies.

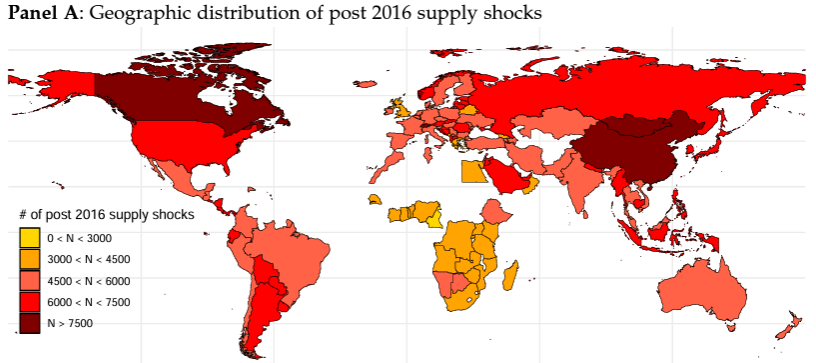

Our paper finds that global supply shocks on internationally traded goods have become more prevalent since 2016, particularly affecting consumer goods and processed intermediates. Here’s a map of these supply shocks.

Explore the data, methods and paper at:

Vir: Prashant Garg via X

You must be logged in to post a comment.