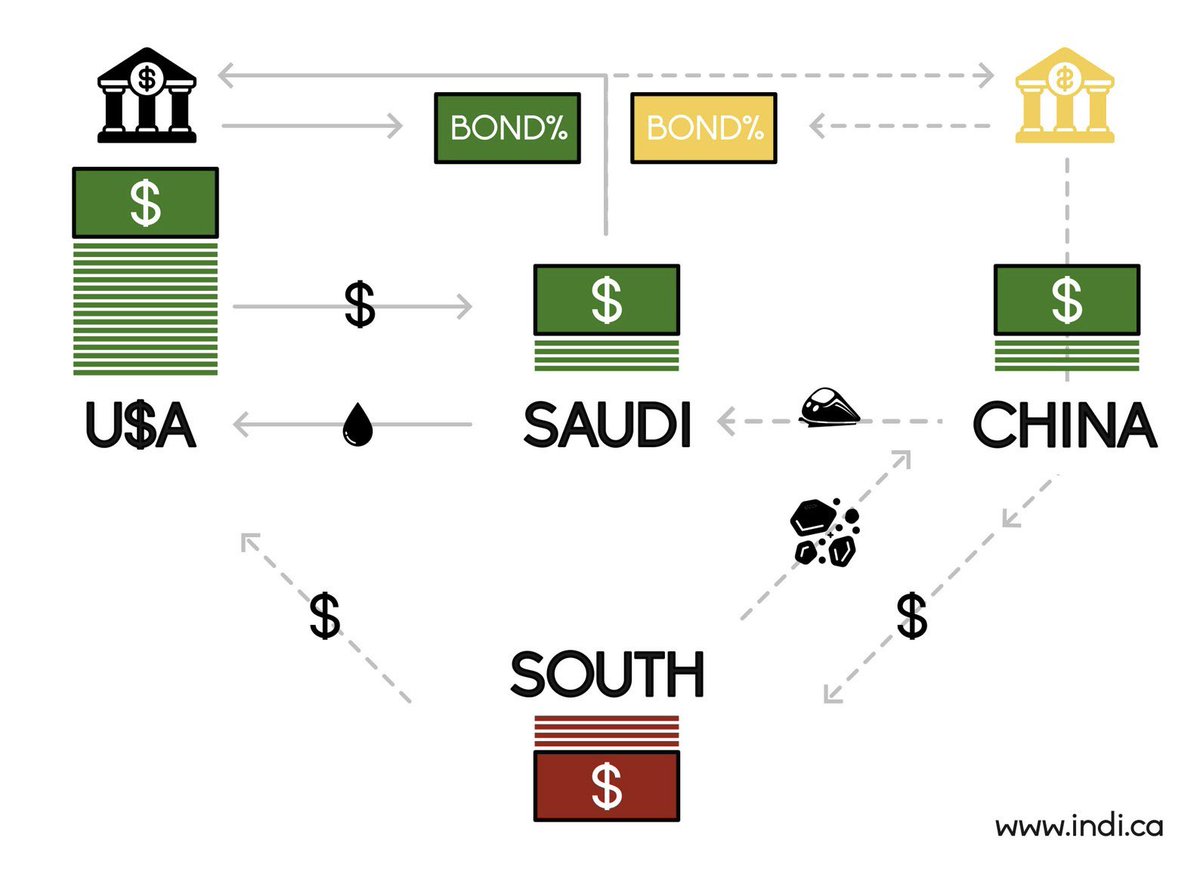

Če morda niste bili pozorni v prejšnjih dneh, ste spregledali novico, da je kitajska banka v Saudski Arabiji izdala obveznico, denominirano v dolarjih. Čeprav je šlo za izdajo majhne vrednosti (2 milijardi $), je zadeva zanimiva iz večih vidikov. Obveznica je denominirana v dolarjih, povpraševanje je bilo 20-krat večje od vrednosti izdaje, obrestna mera je bila zgolj za dlako (1-3 bazične točke) višja kot pri ameriških državnih obveznicah (Nemčija plačuje 10-20 bazičnih točk več za svoje obveznice) in odpira vprašanje, kaj želi Kitajska s tem doseči ter kaj sporoča ZDA in svetu. Ena izmed razlag je, da Kitajska s tem Ameriki sporoča, da se lahko zadolžuje po isti obrestni meri kot ZDA in da lahko ustvari paralelni dolarski finančni sistem, na drugi strani pa državam globalnega juga sporoča, da jim – če imajo težave pri refinanciranju dolga po bistveno višjih obrestnih merah – pomaga s cenejšim denarjem v zameno za izvoz surovin in jih s tem še bolj naveže na svoj trgovinski in finančni sistem. Kitajska s tem signalizira, da lahko zruši monopol ameriškega finančnega sistema in ustvari večjo dovisnost držav globalnega juga od Kitajske.

Spodaj sta dve zanimivi razlagi. Z nobeno se ni treba strinjati, splača pa se ju vzeti na znanje. Najprej Arnaud Bertrand:

At first glance, the mechanics are straightforward: China issued bonds, denominated in US dollars, that investors eagerly snapped up. The bonds were oversubscribed nearly 20 times, with over $40 billion in demand for just $2 billion in bonds. This level of interest dwarfs the typical 2-3x oversubscription seen in US Treasury auctions.

Even more striking is the interest rate. China secured rates just 1-3 basis points (0.01-0.03%) higher than US Treasuries—essentially matching the borrowing cost of the US government. For perspective, even AAA-rated countries like Germany or Japan typically pay at least 10-20 basis points above US Treasuries when issuing USD bonds.

The venue for this issuance—Riyadh—adds another layer of intrigue. Sovereign bonds are typically issued in established financial hubs like London or New York, not in the heart of the petrodollar system. By choosing Saudi Arabia, China appears to be subtly challenging the status quo, showcasing itself as an alternative player in the global dollar ecosystem.

A Subtle Signal to Washington

The timing and nature of this bond issuance seem less about financial necessity and more about strategic signalling. By successfully issuing dollar-denominated bonds in Saudi Arabia, China demonstrates it can compete directly with US Treasuries as a destination for dollar investments.

For decades, the US has enjoyed an “exorbitant privilege,” with countries like Saudi Arabia recycling their surplus dollars into US Treasury bonds, effectively subsidising US government spending. Now, China is introducing a rival option. The bonds give countries like Saudi Arabia an alternative, enabling them to park their dollar reserves with Beijing instead of Washington.

If China were to scale this effort, issuing tens or hundreds of billions in USD bonds, it could carve out a parallel dollar market. This would undermine the US Treasury’s monopoly on global dollar flows, shifting part of the dollar’s management to China.

Why Would China Want More Dollars?

Sceptics might wonder why China, already awash in dollars due to its massive trade surplus, would want to hoard more. The answer lies in its Belt and Road Initiative (BRI).

Out of 193 countries globally, 152 are BRI participants. Many of these nations carry significant dollar-denominated debt to Western lenders. China could use its dollar bonds to assist BRI nations in repaying these debts, effectively buying influence and economic integration. In exchange, China could be repaid in yuan, strategic resources, or bilateral trade benefits.

This strategy achieves several goals for China:

- It reduces its dollar holdings without destabilising markets.

- It helps BRI countries escape dollar dependency, deepening their reliance on China.

- It weakens the US’s financial leverage over these nations.

Implications for the US

The rise of Chinese dollar bonds could have seismic implications for US fiscal and monetary policy. Every dollar redirected from US Treasuries to Chinese bonds reduces the funds available for US government borrowing. This could force the US to offer higher interest rates to attract investors, exacerbating its fiscal challenges.

The US could respond by attempting to dissuade countries and institutions from buying Chinese bonds, but such actions risk undermining confidence in the dollar itself. Recent sanctions on Russia have already spurred many countries to seek alternatives to the dollar to shield themselves from US political interference.

Raising US Treasury yields to outcompete Chinese bonds is another option but would come at a significant cost—higher borrowing expenses for the US government and a potential domestic recession.

The “nuclear option” of restricting China’s access to dollar clearing systems is theoretically possible but would fracture the global financial system, accelerating the dollar’s decline as the world’s reserve currency.

A Tai Chi Approach

China’s strategy here resembles the principles of Tai Chi: using minimal effort to redirect the force of a stronger opponent. By issuing dollar bonds, China isn’t attacking the US system head-on but subtly reshaping its dynamics.

The brilliance of this move lies in its low cost. For just $2 billion, China has forced the US to grapple with a series of uncomfortable possibilities:

- A fragmented dollar market.

- Reduced financing options for the US government.

- A loss of financial dominance over key global regions.

A Calculated Warning

At this stage, the issuance is likely more of a trial balloon than a full-fledged strategy. However, its implications should not be underestimated. As The Times observes, this move could signal to Washington, particularly a future Trump administration, that aggressive economic measures against China might backfire in unexpected ways.

In essence, China is showing it has tools to undermine US financial dominance without needing to confront it directly. For now, this bond issuance serves as both a test of market interest and a subtle warning. The question is whether Washington will heed it—and how it will respond.

Vir: Arnaud Bertrand, The Zimbabwe Mail

_________________

Drugo, bolj plastično razlago pa je dal S.L. Kanthan:

There’s a lot of misunderstanding about China’s new US dollar bonds issued in Saudi Arabia.

Here’s what it will and will not do:

- It’s NOT going to dent the dollar hegemony. Whoever gets the dollar, still must deposit them in U.S. banks.

- What it will do is help poor countries escape the neoliberal tyranny (“reforms”) of IMF and USA.

Example: Say, Nigeria has run out of U.S. dollar in its forex, but must pay back $1 billion this year to Wall Street.

Now, China can come and say, “Here’s $1 billion we raised thru dollar bonds. You can pay us back with oil.”

This saves Nigeria from the Vulture Capitalists of the West.

So, dollar recycling still happens, dollar is still in demand… but the predatory nature of US gets neutralized a bit.

To be effective, China must raise the issuance to a few tens of billions of dollars every year. But if’s too effective, the US will threaten with sanctions.

Vir: S.L. Kanthan

You must be logged in to post a comment.